Given the escalation in sophisticated financial crime, what would be some of the key must-haves when evaluating a strong Enterprise Fraud Management solution?

Given the escalation in sophisticated financial crime, what would be some of the key must-haves when evaluating a strong Enterprise Fraud Management solution?

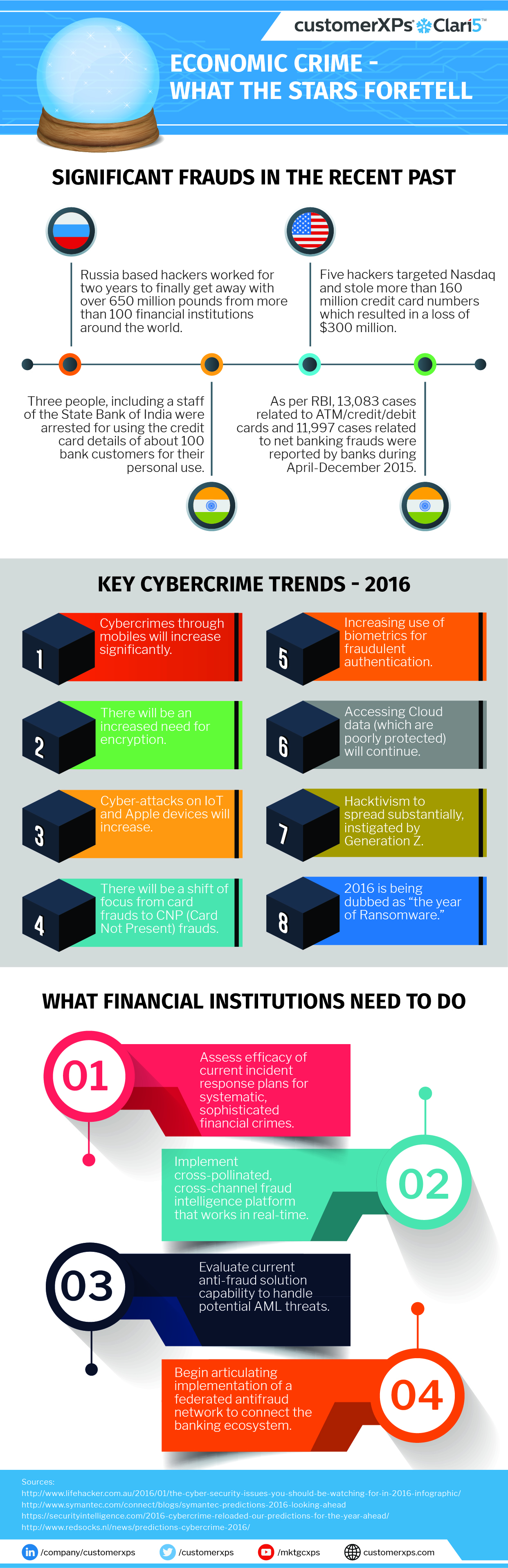

The world of cybercrime is immense. Knowing your enemy is half battle won. Banks have been baffled and ravaged by perpetrators of Cybercrime. This infographic provides a quick peek into the world of cybercrime and helps bankers understand what needs to be done to protect themselves from these ravagers.

A quick round up of select recent cybercrime incidents, emerging trends, a sneak peek in to what will fraud look like in time to come and what banks need to do to combat the menace going forward?

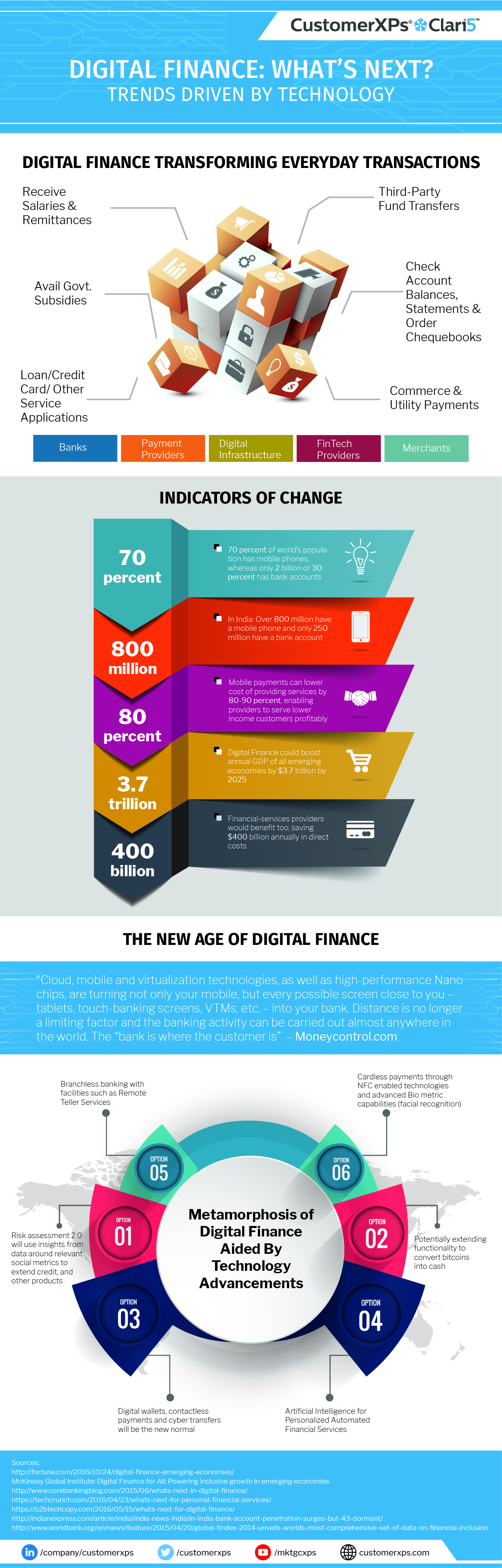

A visual depiction of how digital finance is transforming transactions along with a snapshot of the change indicators

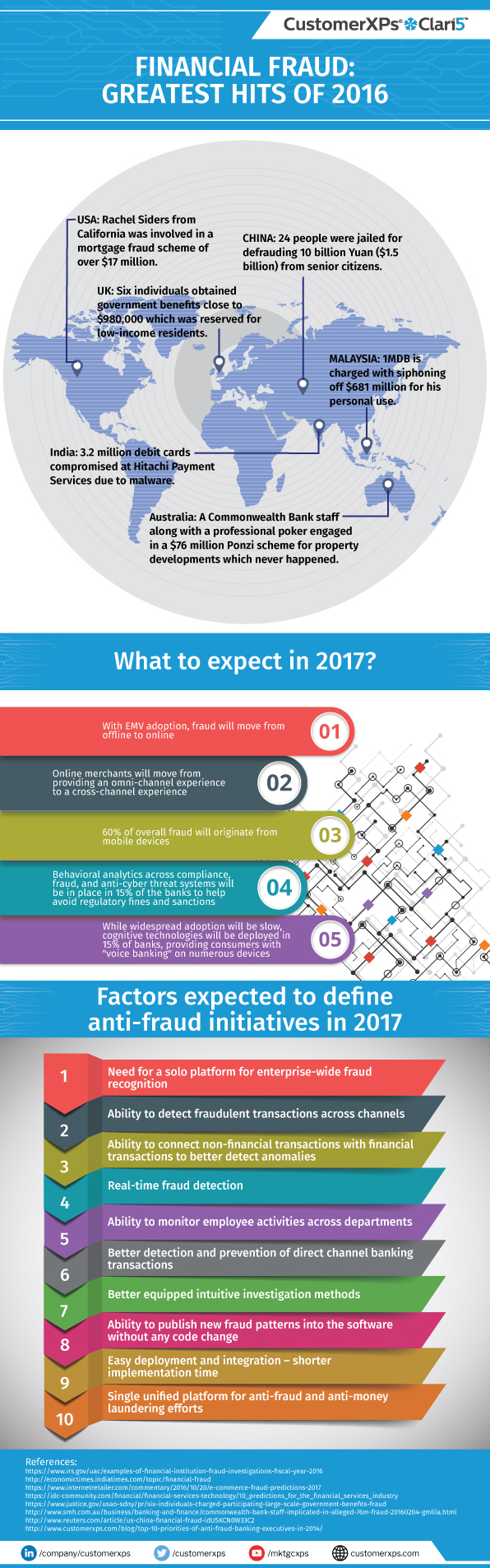

2016 had a financial fraud being committed once every 15 seconds, compelling financial institutions to buckle up. The trend will continue through 2017 with newer, more innovative attempts. Imperative therefore to think innovatively to stay ahead of the game.

US$ 500 million is lost every year to fraud credit card fraud. More the online transactions – more the more the probability of falling prey to credit card fraud. Here’s a sneak peek into the methods fraudsters use.