(First in the two-part series on improving Customer Lifecycle Management in banks)

Image courtesy: @snowing on Freepik

Image courtesy: @snowing on Freepik

‘A 1000-mile journey begins with a single step.’

– Lao Tzsu

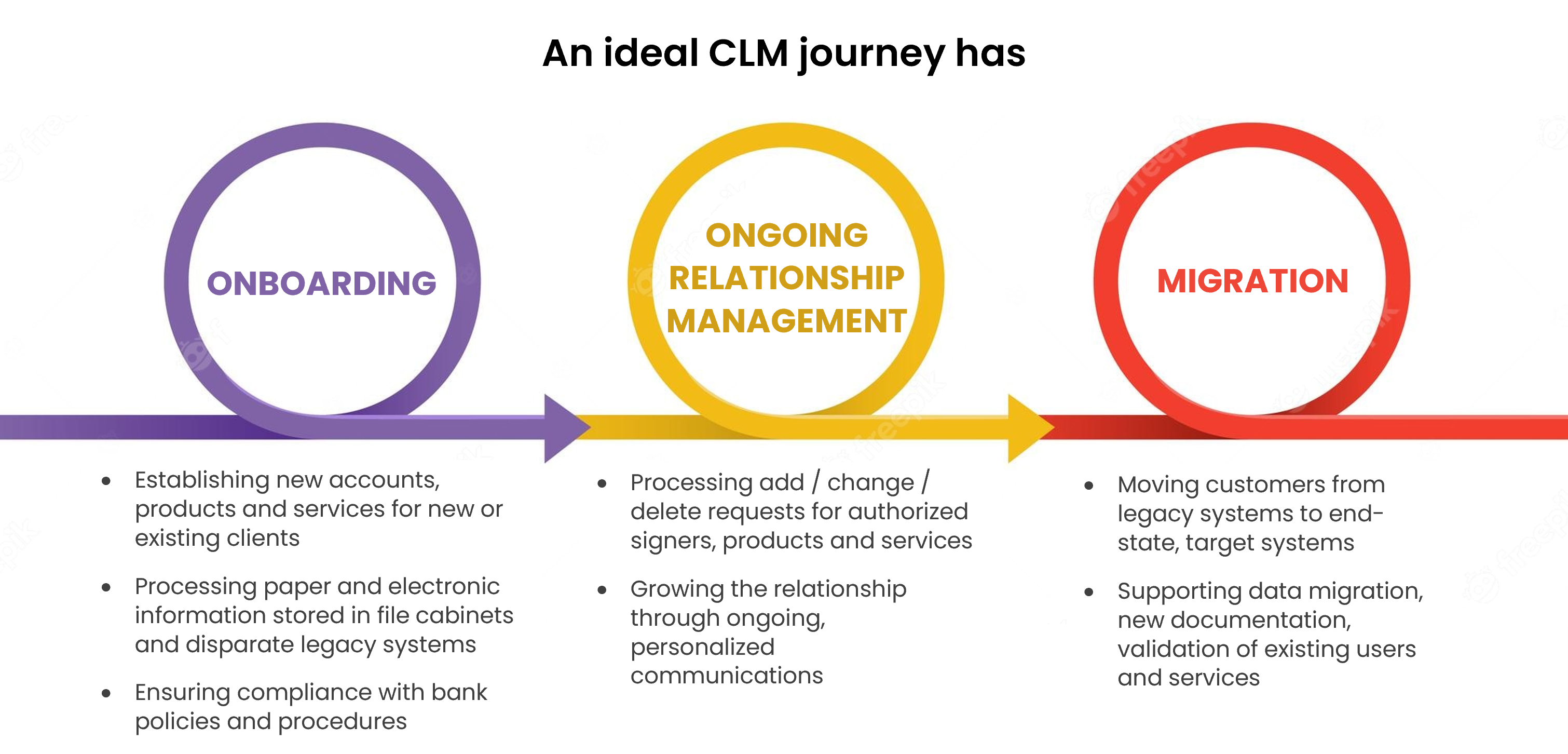

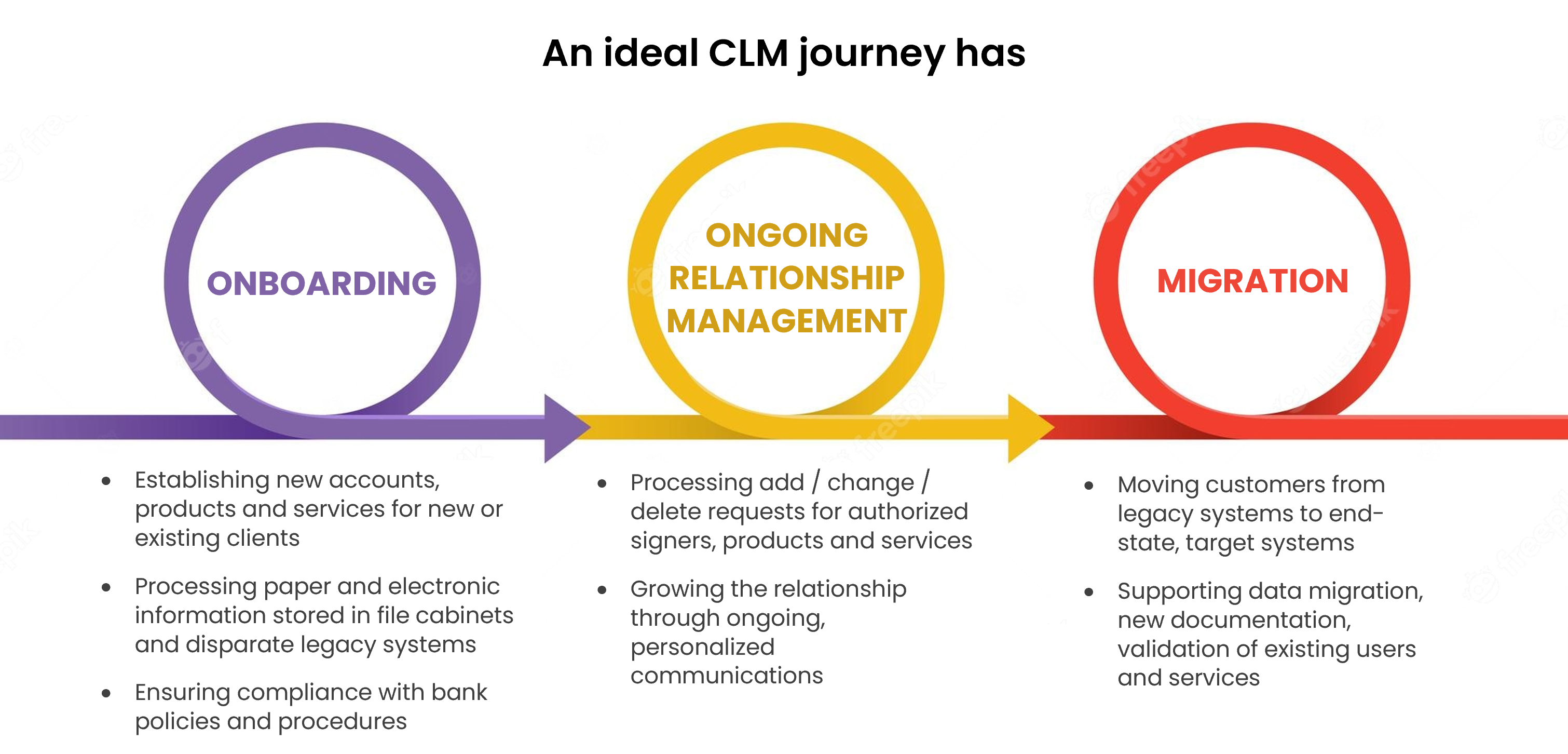

In a fiercely competitive environment, banks have been striving to generate more revenues while trying to increase customer stickiness and curtail customer attrition. The scenario has compelled the need for a holistic approach for creating strong customer-centricity – the key aim of great Customer Lifecycle Management (CLM).

Be it transaction banking or wholesale banking or cash management services, customers continue to generate significant fee-based revenue for banks. So a robust CLM is vital for serving corporate, institutional, or individual customers. And given the intense competition to win customer loyalty, especially with increasing mergers and acquisitions, banks are now investing much more in transforming their CLM processes.

Let’s take a look at step 1 in the CLM journey – Onboarding

Regulatory supervisors around the world are increasingly recognizing the importance of ensuring that banks have adequate controls and procedures in place, so that they know the customers with whom they are dealing. Adequate due diligence on new and existing customers is a key part of these controls. Without this, banks become vulnerable to reputational, operational, legal and concentration risks, which can have significant financial impact.

On the other hand, customers expect convenience, speed + quality of service delivery and personalized service. An efficient Onboarding process reinforces the bank’s customer-centricity while taking care of critical operational risk mitigation procedures such as KYC, Due Diligence, Beneficial Ownership Verification, etc.

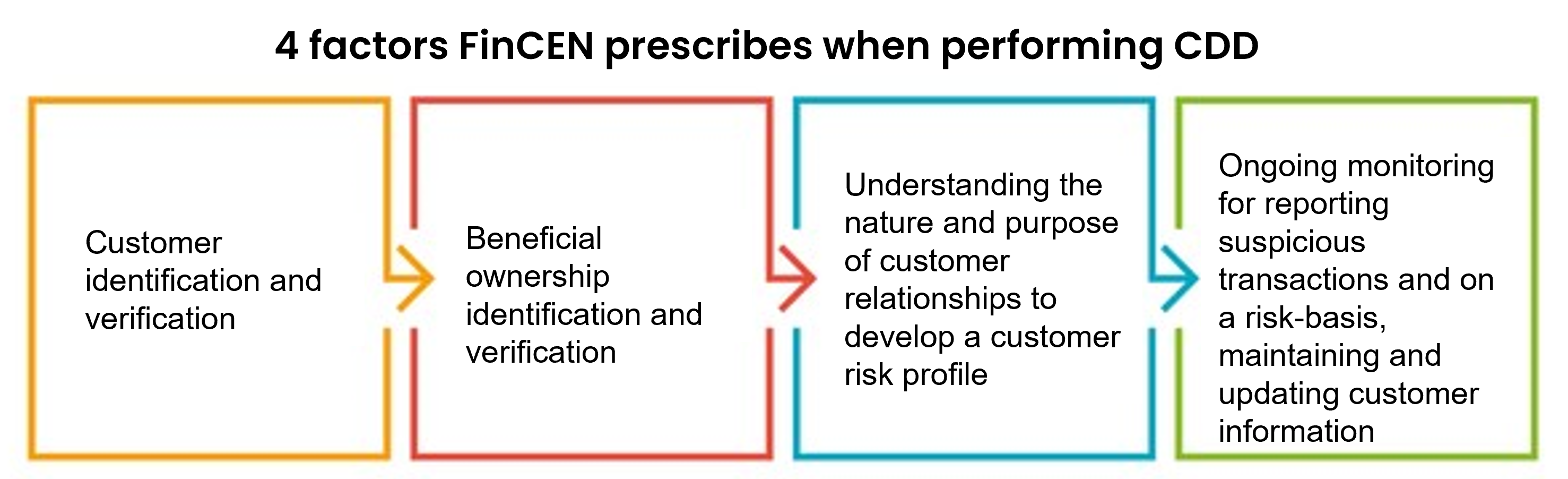

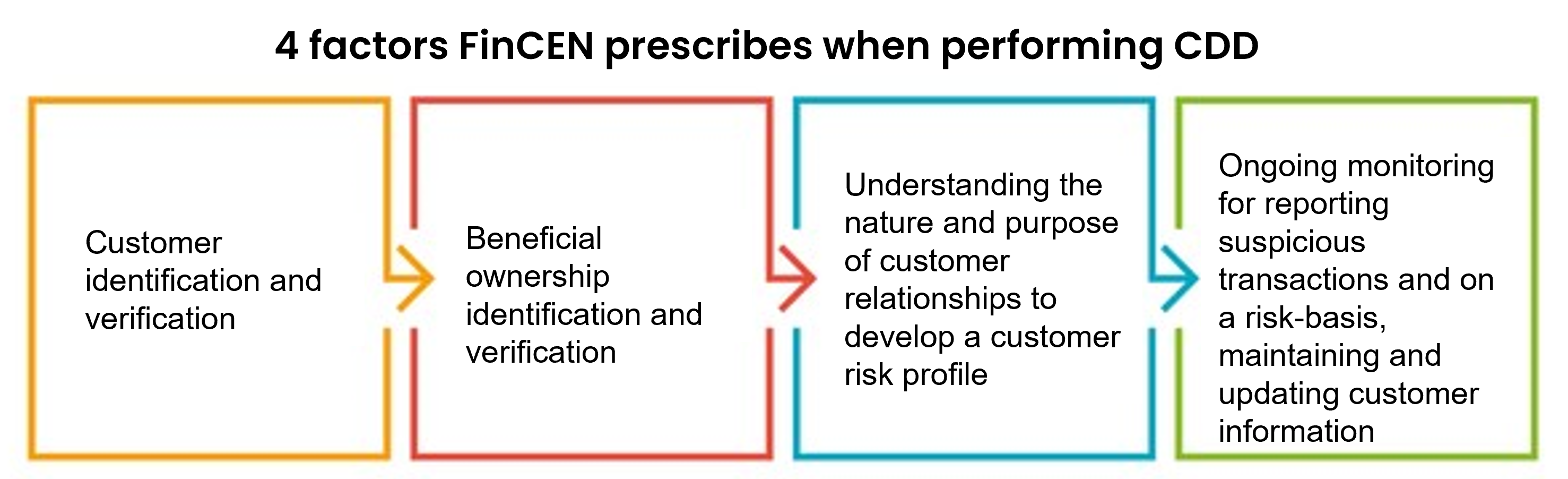

KYC is a critical component in the Onboarding process to help establish the customer’s identity prior to Onboarding and Customer Due Diligence (CDD) is a regulatory norm as part of the KYC process. A bank is required to ascertain the identity of the customer and confirm that funds in the customer account come from legitimate sources.

The first part in a KYC program is a bank’s Customer Identification Program (CIP) which requires collecting and documenting a customer’s name, date of birth, address and identification presented.

The second is Customer Due Diligence (CDD) which requires obtaining information to verify the customer’s identity and assess the risk. If the CDD inquiry leads to a high-risk determination, the bank has to conduct an Enhanced Due Diligence (EDD).

In the US, FinCEN’s CDD rule clarifies and strengthens CDD requirements and requires banks to verify the identity of beneficial owners of legal entity customers.

So, while focusing on delivering a great Onboarding experience, banks must simultaneously ensure and enforce CDD.

CDD helps gauging money laundering risks with a better identification mechanism and mitigates customer-related risks. CRC or Customer Risk Categorization is a risk scoring framework that uses parameters like demographic profiles, geographic, product subscriptions and watch list matches to provide a risk score.

These risk scores are assigned to customers’ profiles during Onboarding and updated along with their journey. Even something as mundane as critical documents expiry updates and notifications, if not handled accurately and on time, can cost banks heavily for non-compliance. In fact, the risk exposure increases when critical information is not updated.

Technology is a key enabler for effective client lifecycle management. There are advanced solutions now available that help banks streamline the complete customer lifecycle assessment and re-assessment of customer risk as part of KYC applicant Onboarding and ongoing CDD processes.

These solutions help streamline money laundering risk assessment, improve understanding of the customer in order to identify, manage and mitigate customer related risks better.

So, what must a bank look for in a good CDD-enabling technology solution?

- Integration with the Onboarding system – The solution should be able to seamlessly integrate with any form of existing Onboarding system to capture customer information.

- A comprehensive risk scoring mechanism for new customers.

- Interactive and dynamic forms & configurable questionnaires based on the customer’s risk score.

- The solution should be able to capture and maintain multiple Beneficial Owner Information for New Accounts.

- Enabled to check against various List / Sanction Screening against Customer and Beneficial Owner information, which supports –

- External private company data providers

- Comprehensive List Management that supports various list providers and custom internal lists

- Intuitive user interface for List Rule Configuration

- Advanced Identity Resolution Analytics Engine that supports fuzzy and exact match algorithm for fields

- An integrated case management system for case creation and reporting.

To determine the relevant risks, 10 key customer information points that banks must collect are:

- Nature of business

- Purpose of account

- Expected pattern of activity (volume, nature of transactions and amounts)

- Origination and destination of funds

- Basic business documentation

- Business customer’s customers (e.g., international customers or banks)

- Nominal and beneficial owners of the account

- Business reputation and references

- Other business and personal business interests

- Location of business in relation to bank

This is not exhaustive, and banks may need additional information depending on specific facts, but its good enough to start with.

These insights, together with a strong CDD-enabling real-time, cross-channel technology solution can help banks streamline the Onboarding experience as a first step towards a great customer lifecycle journey.

To know how to manage the journey ahead and improve Customer Lifecycle Management in banks, stay tuned for the upcoming part 2 on ‘Enriching the Journey Ahead with Exceptional Customer Lifecycle Management’.

Enriching the Journey Ahead with Exceptional Customer Lifecycle Management