From a monetary value perspective, the severity of impact of lending fraud is far greater for financial institutions (FIs) when compared to other fraud risks. With timely loan recoveries being a key contributor to a financial institution’s growth, smaller banks, community banks and credit unions take a bigger hit than their larger counterparts when it comes to loan frauds.

Loan fraud is impacting small FIs – smaller banks, community banks and credit unions, at twice the rate of larger competitors. According to a prominent survey, monetary losses for smaller FIs last year amounted to 6% of overall revenue, compared to 3% for larger institutions.

Even as banks of all sizes continue their fight against consumer loan fraud, loan frauds in small FIs is intensifying the threat. From fake / synthetic ids to launching cyberattacks to infiltrate account creation to attempting account takeovers, fraudsters are deploying tactics similar to consumer loan fraud to target the FI lending process in small FIs.

With lending in small banks shifting to online, fraudsters have a larger opportunity to attack. Attacks targeting new small business account creation increased by 35% and id spoofing by 20%.

Community banks, small banks and credit unions comprise a vital component of the economy, but have higher rates of lending fraud. The 2 primary reasons are – lower investments in technology and higher dependence on manual assessments.

Bad loans and fraud. Are they connected?

From business loans taken with no payback intent to loans taken using false business ids to multiple small business loans taken by the same fraudulent borrower, the variety and size of loan frauds in smaller financial institutions has been growing steadily.

Post loan sanction, the monitoring is weaker than at larger banks because of the lack of adequate expertise and current technology. Also, a large proportion of loan frauds gets misclassified as bad debt.

Loan frauds also happen when bank employees collude with borrowers and/or with the representatives of third parties such as lawyers or accountants. In some cases, the colluding bank employees retire before their involvement is discovered.

Weak selection processes, lower wages than at larger banks, not enough incentivization to detect frauds early are also contributing factors.

How to Detect Loan Fraud?

Loan fraud detection can be tricky. Loan fraudsters frequently change banks or states, making it difficult to spot patterns or a business trail. However, there are certain red flags such as –

- Rapid, sizeable decline in liquidity unsupported by business conditions.

- Excessive change in accounting staff or procedures or changing accounting firms frequently.

- Excessive photocopies of invoices, particularly if they are out of sequence.

- Excessive numbers of checks to cash.

- Mismatch between number of employees relative to business volumes; false payroll using nonexistent employees.

- Asset transfer without sound business reason or at less than fair value.

- Large number of business accounts inappropriate to business needs.

- Misdirection of customer payments (e.g., current payment used to pay older accounts).

- Use of fake or shell entities to manipulate goods and services.

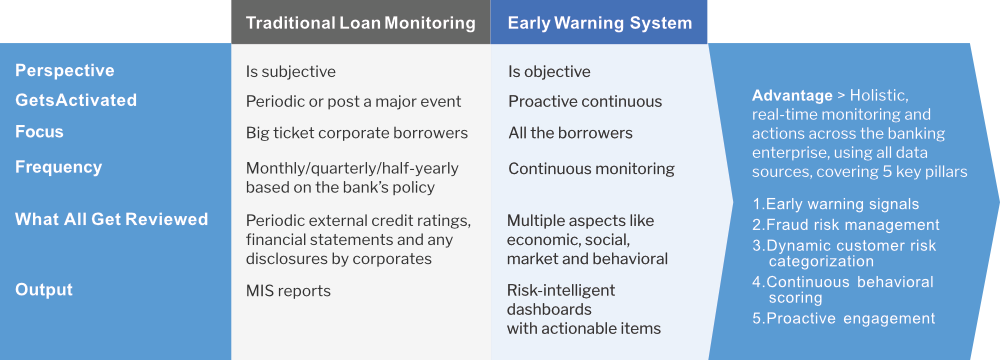

Even though assets and loans are closely monitored, there are certain drawbacks in conventional monitoring methodologies. Traditional monitoring is subjective, gets activated typically after a major event and the focus invariably is on large corporate borrowers.

Review frequency can be anywhere from monthly to quarterly to even half yearly based on a bank’s policy. Also, what gets reviewed are periodic external credit ratings, financial statements, and any disclosures by corporates. Review outputs are typically in the form of MIS reports.

How does smarter anti-fraud technology help

Loan portfolio management requires using massive and diverse data plus substantial processing capability to serve a large number of variables. Besides helping banks enhance loan performance, applying smarter loan fraud detection practices delivers superior advantage.

However, archaic and / or stand-alone loan fraud detection systems don’t help much with the early warning signs of non-performing or fraudulent loans.

Data analytics plays an important role. Fraud investigation teams in banks can use varying levels of analytics to identify fraud. This is usually done using historical transactions/events to predict the likelihood of a future transaction or event being potentially fraudulent.

There are reactive analytical techniques performed against the bad debt cluster to detect the fraud required to train business rules and models to predict future fraud.

There are also proactive techniques that make it easier to detect suspicious applications and accelerate the investigation process. There’re also hybrid analytical approaches that use business rules and predictive models.

The use of anomaly detection or social network analysis helps detect fraud without having to train rules and models on historic known frauds, thus reducing the effort required to start uncovering hidden frauds.

A more efficient way to spot the bad eggs (before they go bad)

An innovative approach helps smaller banks do more to detect fraud hidden in bad loans to reduce losses and increase approval rates.

The approach is about viewing loan monitoring through the lens of enterprise-wide financial crime risk management (EFCRM).

A real-time EFCRM system is already built to swiftly pull information from across all channels of the bank and bring to bear the essence of the insights in real-time for necessary intervention.

Given its inherent ability to synthesize account/customer information contextually and in real-time, the same principle can be applied to monitoring loans.

A good real-time EFCRM system already has cross-channel coverage across online, mobile, branches, alternate delivery channels and business products; real-time transaction monitoring to detect fraud during transaction authorization within the transaction window itself; entity link analysis to analyze relationships between internal and/or external attributes to detect collusive activities or misuse.

It also has canned intelligence and analytics with behavior profiling and predictive scoring models that run out-of-the-box activities from channels and are automatically co-related to detect suspect transactions; embedded use-case knowledge; alerts for analysts/investigators and rules engine to create/update rules and a system design that minimizes deployment and support tasks.

Therefore, using the same EFCRM platform for loan early warning signals provides holistic real-time monitoring and actions across the banking enterprise using all data sources and covering the 5 vital aspects, i.e. early warning; dynamic customer risk categorization; continuous behavioral scoring and proactive engagement.

A real-time, cross-channel EFCRM-based LEWS tracks financial, behavioral and external indicators and flags sudden value changes in these indicators.

Activating EFCRM-led loan early warning system

Banks often take the easy route and implement an out-of-the-box generic loan early warning application that will not take into account the specific circumstances of the small FIs and thus, not deliver the desired business impact in NPA reduction.

A standalone loan early warning application can further complicate the IT application landscape of the bank and undermine its NPA management program.

A loan early warning system is much more efficient when it is synchronized with the FI’s overall enterprise financial crime risk management strategy. When creating an early warning framework, defining the triggers and integrating them with the real-time, cross-channel EFCRM platform becomes a critical success factor.

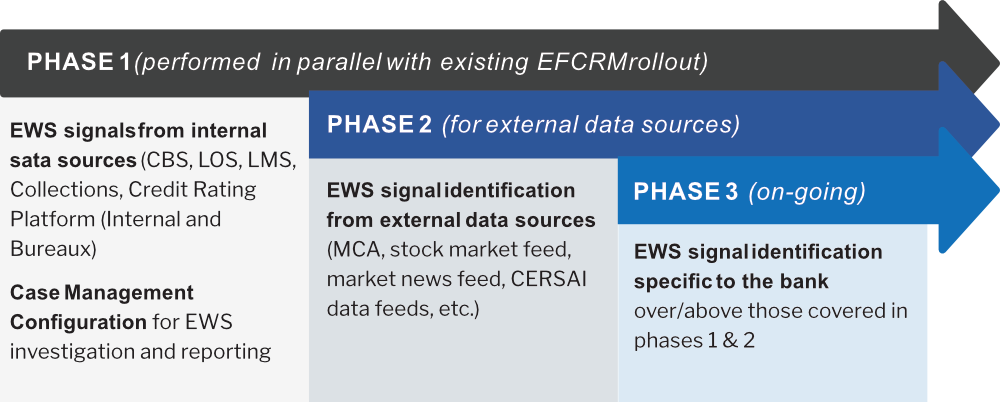

From a deployment perspective a phased approach is ideal when implementing an EFCRM-led loan early warning system.

Most of the bank’s core systems are already integrated for monitoring and detecting fraud as part of a real-time, cross-channel EFCRM system’s roll-out.

So, the essential data required for monitoring loans is already readily available without any additional effort. This helps exponentially accelerate the loan early warning solution go-live.

The second phase is a bolt-on over the previous setup and ingests inputs from external sources. Integrating the system with external data sources, for data ingestion and configuration of scenarios with additional insights incoming from external data points, is initiated soon after.

The overall system architecture is deliberately agile yet scalable to respond to newer requirements and can get configured / reconfigured as / when requirements change. Phase 3 addresses this aspect.

Despite assets and loans being closely monitored, there are drawbacks in conventional monitoring methodologies that are subjective and gets activated typically after a major event. Also, the focus invariably is on big ticket corporate borrowers.

For smaller financial institutions, the immediate consequence of an increase in bad loans is higher capital requirements to absorb potential losses and the rising cost of funding, management, and administration.

Smaller banks, community banks and credit unions can and must have consistent and reliable data available to recognize signs of both stress as well as fraud at an early stage.

Smaller banks, community banks and credit unions can do more to detect fraud hidden in bad debts. A real-time, cross-channel banking Enterprise-wide Financial Crime Management (EFM) solution can help uncover and reduce hidden fraud much more efficiently – the obvious benefits being reduced losses and increased approval rates.

An integrated and comprehensive real-time, cross-channel EFCRM-based loan early warning framework that includes identifying the right customer segment, understanding the data landscape, formulating early warning triggers and creating a risk mitigation plan can deliver a radically effective way to mitigate loan fraud risk.

Additional resources: View Clari5 Loan Origination and Monitoring Solutions.