Frequently asked questions

Frequently Asked Questions

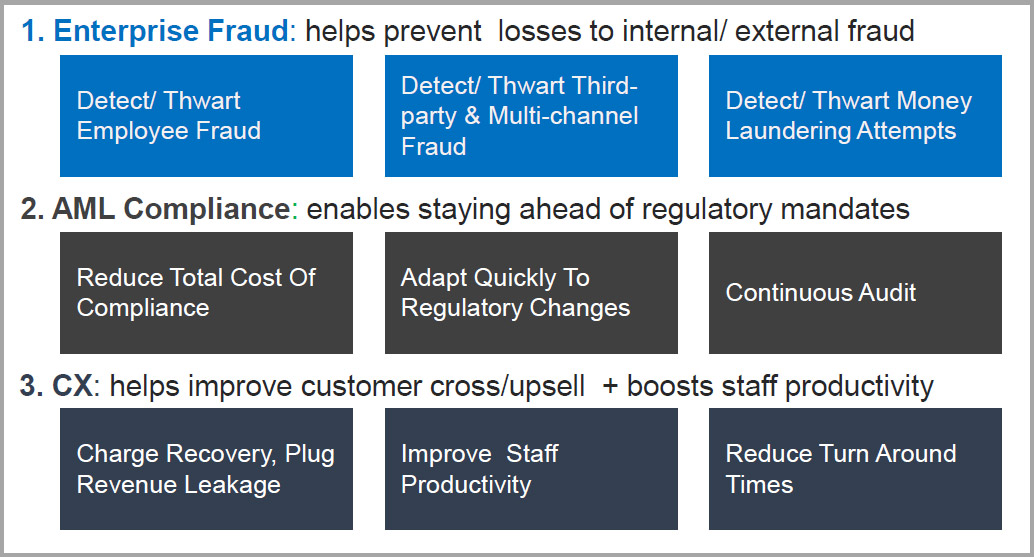

Clari5 is the acclaimed banking enterprise financial crime risk management product from CustomerXPs, that helps banks efficiently combat fraud and money laundering in real time, by synthesizing ‘contextual’ intelligence from all channels of the bank.

Clari5 is a context aware, customer aware solution that monitors 360 degrees, digesting all transactions and actions. Additionally, banks can also use the same fraud intelligence for cross sell and upsell.

Clari5 exists because ‘trust’ is central to banking.

Clari5 exists to enable banks to maintain and leverage this ‘trust’ every time.

Clari5 exists for every bank that is exposed to the global $4 trillion* problem of fraud.

*Association of Certified Fraud Examiners (ACFE) Report to the Nations, 2018

Everyday the world wakes up, Clari5 makes available ‘whatever the world has learnt till then’

intelligence to be used for every decision related to ‘trust’.

Using global networked intelligence and technologies including AI, ML, Cloud Computing, Blockchain and RPA, Clari5 delivers on this ‘trust’ promise

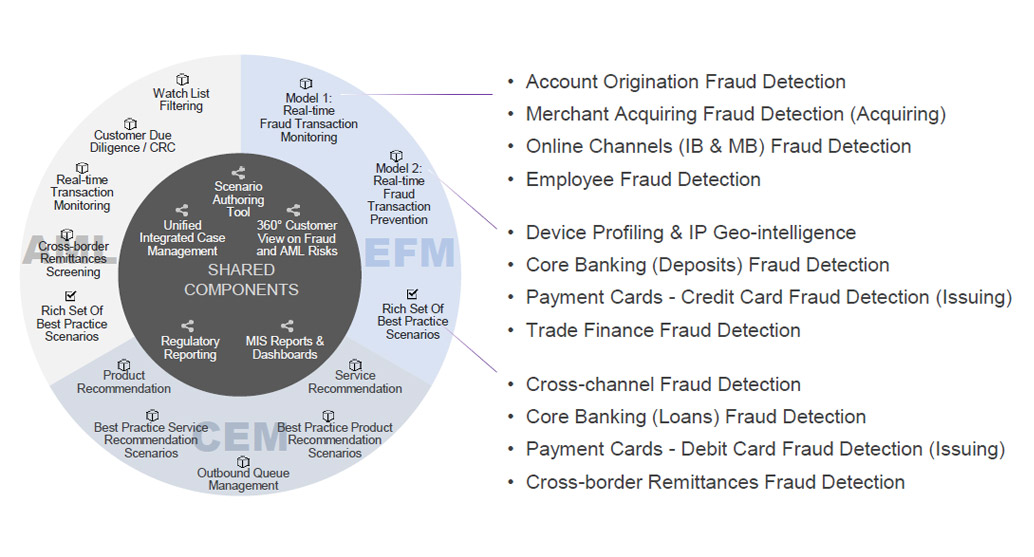

Clari5 uses an innovative ‘central nervous system’ approach by summoning insights from multiple systems to contextually detect

potential fraud in real time, within the short transaction window itself.

This differs from the siloed, single channel centric approach of conventional technology solutions.

- Extremely real time with very short response times within the transaction window itself.

- Draws intelligence from all channels with Core Banking as pivot, as opposed to other solutions which focus on individual channel silos and try to stich it together.

- Manages fraud across all channels including Branch, Payment Cards, Internet Banking and Mobile Banking for all lines of business using a ‘segment of one’* approach.

- Silo breaker User, Account, Customer and Bank centric cross channel and cross product intelligence.

- Pre packaged Channel and Product specific detection and scoring models.

- Inbuilt easy to use GUI tool that enables banks’ business users to create, edit or delete scenarios themselves (no programming knowledge required).

- Dynamic Behavior Profiling algorithms for Customer, Accounts and Channels (e.g. preferred ATMs, preferred Beneficiaries, preferred Channels).

- Multi layered event enrichment based intelligence for reduced false positives.

- Enterprise Case Management with a unified view across Channels and Products including access to real time Dashboard and Reports.

- Runs on commodity hardware thus lowering the TCO.

- Unified real time intelligence platform for managing both Fraud Risk and Money Laundering.

- Fully real time Anti Money Laundering solution.

- Integrated RPA capabilities for advanced and faster investigation process.

- Features pre built integration adapters for banking systems leading to quicker implementation. Clari5 typically goes live in 4 6 months.

*A bank captures the ‘soul’ of the customer because the entire life of the customer has gone through it. When this soul is summoned for every transaction in real time, it makes every interaction a highly contextual, segment of one.)

Clari5 has the world’s largest real time implementations working with over 200 million accounts in a single bank.

Clari5 is processing more than 10 billion events and is monitoring over 450 million accounts across customer banks in 15 countries.

Clari5 uses a blend of AI, Real time Decisions and Automation technologies:

ML powered intelligence

Predictive scoring using trained ML models, scenario/pattern discovery, pattern intelligence from cross institutional analysis, machine intelligence from low data density environments.

Real time decisions

Real time decisions of transactions using ML fueled intelligence and known patterns; decisions that are explainable and traceable.

Investigation automation

Red flags & specific additional due diligence processes are automated using RPA, specially for decisions that need more information beyond the enterprise boundaries.

Clari5’s clients are progressive banks in 15 countries who trust Clari5 for driving their fraud risk management strategy.

These banks are also recipients of global industry acclaim for running Clari5, such as Celent Model Bank of the Year Award, The Asian Banker Best Operational Risk Technology Implementation of The Year, Banking Technology (UK) Best Use of IT for Risk and Compliance, etc.

Being a ‘bolt on’ system that is engineered to run on commodity hardware, Clari5 leverages up on the bank’s existing siloed investments. Clari5’s unique architecture ensures horizontal linear scaling using commodity hardware.

This also helps reduce the system go live schedule to a sub 90 day timeframe.

Clari5 protects your bank’s bottom line by reducing fraud losses with effective cross channel fraud management, protection against revenue leakage, reducing cost of compliance, proactive regulatory reporting and managing process compliance.

Customers report over $30 million/year of savings to their bottom line

Clari5 improves your bank’s top line revenue.

A benefit of real time change fraud management is that your bank can convert fraud management into a revenue generating activity by using positive cases post fraud assurance in real time. This can also include real time 24×7 revenue recovery.

One customer generated over $25 million/year using this approach.

Clari5’s cross pollinated intelligence dramatically improves people productivity as they have instant ‘in the moment’ synthesized intelligence available for them to perform their tasks quickly and efficiently.

Client banks have reported significant month on month savings with respect to the turn around time of agents, fraud investigators, branch staff and relationship managers.

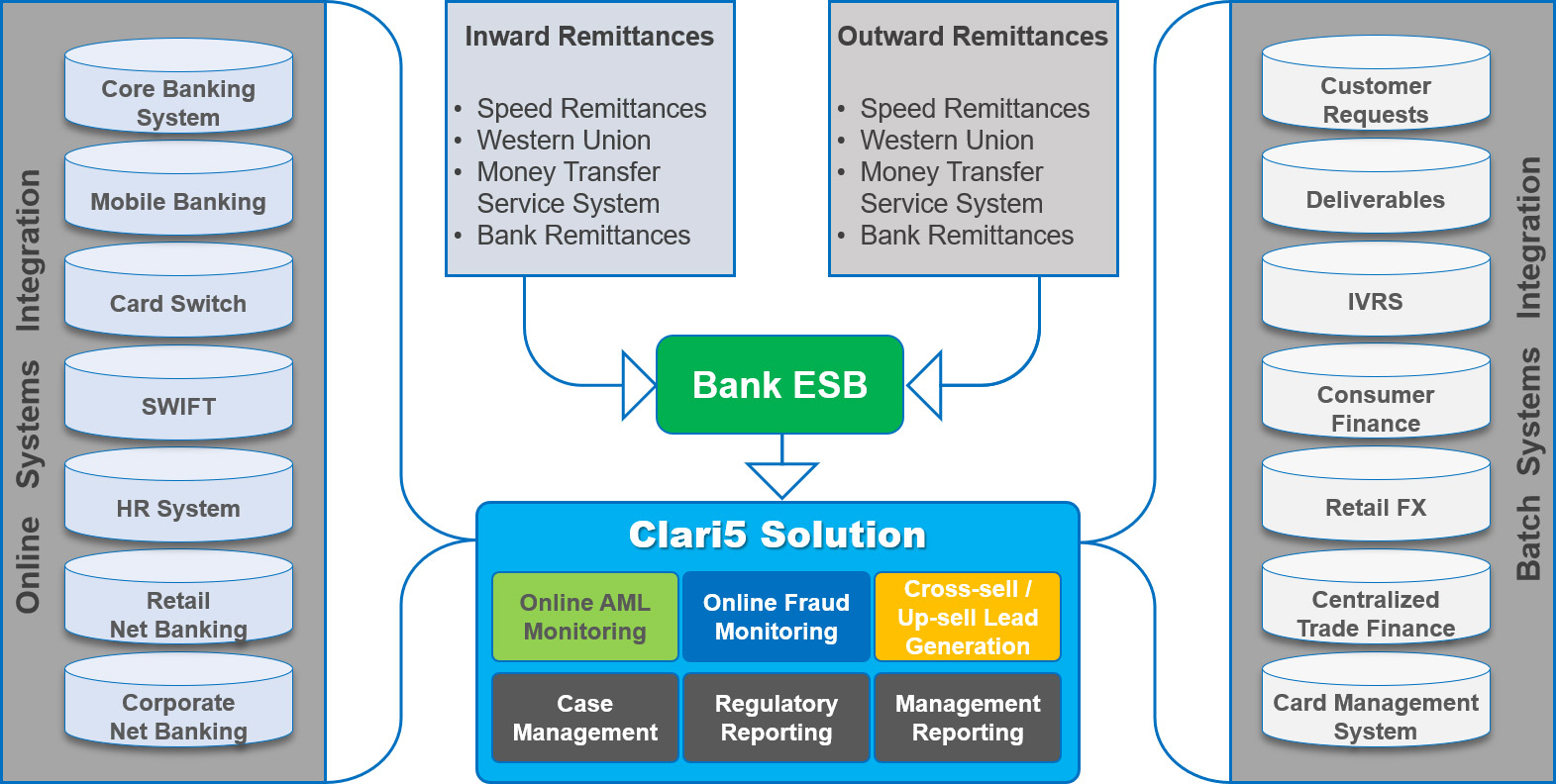

Clari5 is engineered to seamlessly integrate with all leading systems such as:

As a first step, banks desirous of scheduling a Clari5 product demonstration can do so by clicking here

Need more information

If you are looking for an answer to a question that’s not listed above, please reach out to us.