Clari5 Real-time Anti-Money Laundering

Clari5 Real-time Anti-Money Laundering

Clari5 Real-time AML solution helps banks and financial institutions automate, streamline and comply with existing and emerging regulatory AML/CFT compliance programs. The solution suite comprises of 6 key modules viz. Suspicious Activity Monitoring, Customer Risk Categorization, Entity Identity Resolution/Watch List Filtering, Regulatory Reporting (CTR/STR/SAR/FATCA), Case Management and Entity Link Analysis.

Real-time AML solution

Download Real-time AML Solution Brochure

- Fully automated AML compliance program starting from customer on-boarding to ongoing relationship monitoring

- Monitors suspicious money laundering activities in real-time and takes the right decision at the right time as opposed to end of day reporting and analysis

- Compliance with regulators by timely filing of various regulatory reports including CTR, STR/SAR reports

- Integrated reports and dashboards providing insights on the efficiency and effectiveness of the AML System

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation owing to pre-packaged AML scenarios and built-in interfaces for integration

- Low cost commodity hardware infrastructure leading to reduced TCO

Watch List Filtering

To counter money-laundering attempts, Financial Institutions (FIs) are required to comply with sanctions and PEP program regulations. Financial Institutions are required to screen customers during on-boarding and at regular intervals to ensure that they do not have business relationships with individuals and entities present in various sanctions lists or watch lists. Banks therefore need to implement an efficient real-time watch list filtering solution that requires minimal manual intervention and operates with very low false positive rates to avoid impacting customer experience.

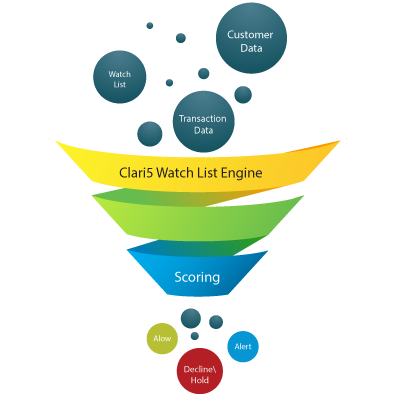

Clari5 Watch List Filtering helps your bank comply with regulatory sanctions and PEP programs with real-time advanced identity resolution analytics, intelligent scoring, transaction blocking and alert generation, with proven low false positive rates.

Download Watch List Filtering Brochure

- Advanced Identity Resolution Analytics Engine

- Comprehensive List Management

- Real-time Transaction Blocking and Alert Generation

- Intuitive UI for List Rule Configuration

- Support for Online and Batch Screening

- Integrated Case Management

- Automated Reporting and Regulatory Filing

- MIS Reports and Dashboards

- Improved regulatory compliance with a single proven solution for customer and remittances transaction filtering, in real-time

- Mitigate business risk from monetary penalties and reputational damage

- Ensure compliance with consistent AML policies across the banking enterprise

- Reduced operational investigation costs with proven low false positives

- Automated filing of STR/SAR regulatory reports

goAML Reporting

The goAML application is fully integrated software solution developed specifically for use by Financial Intelligence Units (FIU’s) and is one of UNODC’s strategic responses to financial Crime, anti-money laundering and terrorist Financing.

Developed by United Nations Office on Drugs and Crime (UNODC), goAML is intended for use of FIU’s as a means for gathering regulatory reporting information and allowing regulatory report entities and intelligence authorities to analyse and share information that can help identifying a criminal activity in a quick, secure and confidential method.

The goAML solution performs for following major functions

- Collection of Suspicious Transaction Reports (STR) , Currency Transaction Reports (CTR) etc.

- Information dissemination including escalations to law enforcement if required

- Analysis of data based on rules, risk scoring and profiling

Clari5 goAML regulatory reporting is fully compatible with UNODC standard reporting requirements such as but not limited to following

- Suspicious Transaction / Activity Report – STR / SAR

- Currency Transaction Report – CTR

- Additional Information File (With/Without Transaction) – AIF

- Politically Exposed Person – PEP

- Electronic Fund transfer Report – EFT

- Web based PO / MLRO workbench for all goAML regulatory report filing

- Supports Investigation Led reports

- Ability of generating reports in Batches. Individual reports can be batched or unbatched

- Seamless Integration with any Case Management systems and AML systems

- UI based reporting for any Ad-hoc reporting requirements

- Real-time intelligent dashboard to track overdue and pending report submissions

- End to end reporting from generation till acknowledgement upload

- Ability to view, modify the report before submission from PO / MLRO workbench

- Custom component to accommodate any additional reporting attributes other than goAML standards

- Data Analysis using rules, risk scores and behaviour profiling

Clari5 goAML Solution supports all the 50 registered countries such as UAE, Kenya, Ghana, Tanzania, Sri Lanka, Zambia, Ireland, Switzerland, Germany etc.

How can Clari5 help my bank?

Schedule a Demo

Schedule a 1:1 discovery demo call with our senior product experts to see how Clari5 works and have all your questions answered!