White Paper: Break Filter Bubbles in Banking Enterprise Fraud Management

White Paper: Break Filter Bubbles in Banking Enterprise Fraud Management

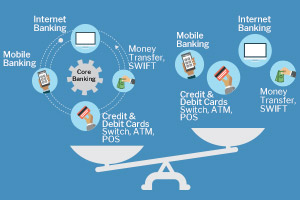

Banks need to synthesize holistic wisdom from core systems and not just from channel silos. From depth of analysis, ease of configuration/ implementation and cross channel fraud detection to insider fraud detection and real-time high availability, a synchronized Enterprise Fraud Risk Management approach delivers compelling advantages over a Delivery Channel silos only approach. Read More

Report: NASSCOM IT Strategic Review 2017 – featuring CustomerXPs

Report: NASSCOM IT Strategic Review 2017 – featuring CustomerXPs

The premier IT industry association expects emerging technologies in fintech to strengthen this year. While core banking continues to be the mainstay of fintech, new developments in fintech are enabling banks and customers to go digital. Analytics, automation, fraud management, machine learning and blockchain are to take a big step ahead. Read More

Banks & Fintech Startups See More Value In Cooperation Than In Rivalry

Banks & Fintech Startups See More Value In Cooperation Than In Rivalry

Read about how ICICI bank’s first tryst with fintech involved getting their customer service to climb up the experience curve. The article talks about how CustomerXPs built augmented intelligence that dipped into the bank’s internal systems to create profiles of customers, their relationship with the bank and the best product they were likely to buy next. Read More

Blog: Monetizing Your Anti-Fraud Solution to Make Money for Your Bank

Blog: Monetizing Your Anti-Fraud Solution to Make Money for Your Bank

In Chinese philosophy, yin and yang explains how seemingly opposite or contrary forces may actually bring balance in the natural world. This idea actually applies perfectly in the context of application of enterprise level fraud management systems. Read More