The volley of financial services offered to and engaged by a common man today demands sophisticated systems to collect and connect their data. Regulatory compliance and customer due diligence carve out the biggest chunk of a financial firm’s time and resources: on an average, $60 million[1] per firm per year. Robotic process automation in banking has the potential to overhaul these processes and replace them with time- and cost-effective workflows. It streamlines the communication between disparate bank systems to create a holistic financial footprint of the customer while reducing effort and expenditure.

Although RPA has existed inconspicuously in many banking processes, it enters its renaissance with the help of Machine Learning (ML), Natural Language Processing (NLP) and Artificial Neural Networks (ANN). Together, these technologies constitute the broad domain of Artificial Intelligence (AI). They drive human-like operations without much intervention from employees in the repetitive tasks. The re-invented RPA is likely to become the core of most bank fraud-detection and customer experience processes in the present market.

Clari5, the ML-driven cross-channel enterprise financial risk management suite, leverages RPA-integration to automate risk assessment and fraud investigation solutions end-to-end. It can pull data from multiple channels (Credit, debit, loan, mortgage etc.) in real-time and trigger instant alerts to manage cases with minimal human oversight.

In a preemptive effort to fight financial crime, larger banks are opting to use such automatedmulti-jurisdictional platforms to pull customer information from all service lines, rather than creating yet another silo for technology. And RPA is the enabler behind this evolved strategy.

The Concept: Fin-bots and their ‘Brains’

Contrary to popular belief, RPA doesn’t mean assigning the corner office to RoboCop and saving on his (or its?) employee benefits. The ‘Robot’ in robotic process automation refers to a software bot that automates certain tasks that are too monotonous and mundane for the human mind. It’s equipped with a conceptual ‘brain’ that ‘learns’ the procedure programmed into it. It’s akin to reading a book and following the instructions to the letter except the bots can do it faster, cheaper and without human error.

With the advent of Artificial Intelligence aided by machine learning, these bots are further granted with cognitive capabilities that enable judgment-based actions.ML facilitates automatic learning and improvement in such intelligent systems. Bots learn by analyzing known or unlabeled datasets. They use their inbuilt learning algorithm to create models and make predictions about the output values of the datasets.In banking, this gives the bots greater autonomy and reduces the need for human supervision through the course of recognizing alerts, collecting customer data, credit scoring, and subsequent fulfilment activities. While they would still require some human touchpoints in the process, they can resolve issues with modelized data just like a human would.

NLP takes the capabilities of these bots to the next level by coaching them to decode unstructured datasets like free-form text. The combination of NLP and ML helps RPA-integrated bank fraud detection systems to capture customer data from multiple avenues, evaluate it, convert it to an actionable form and dispose it to concerned teams. Artificial Neural Networks simulate the human brain and are an advanced tool to upskill the fin-bots.

Integrating RPA into banking involves ‘training’ these software bots to perform tediousevidence-gathering tasks involved in tracking and flagging fraudulent activities. The resultant processes can be semi-automated or fully automated. To determine the extent of integration required, the manual proceduresinvolved must be analyzed. This helps firms recognize the high-volume, low-value actions. These actions can be coded into ‘if-then’ scenarios with minimal deviations and complemented by error-handling capabilities. In short, a software bot takes them over.

Pitting RPA against Bank Fraud

While there are plenty of uses cases, robotic process automation makes the most sense in a field like enterprise financial crime management. Firms now proactively monitor suspicious activity and enforce strict regulations to prevent financial fraud which might harm their customers and their reputation. As almost 80-90% of the new services are availed by existing customers, it’s that much more important to map their past and current transaction patterns to predict future threats. And if there’s a way to speed up and ease the process, it’s worth exploring. Enter RPA.

Both bank fraud risk assessment and anti-money laundering operations demand data collection from multiple legacy systems.RPA engages the conditional if-then algorithm to collect the information from all silos and highlight the anomalies in a complete financial profile.

In the semi-automated scenario, the bot can beassigned with a list of actions that are triggered when the risk analyst or fraud investigator runs the program. This would automatically take screenshots of the relevant accounts/details and collate them for manual scrutiny. Or the task can be fully automated such that once triggered, it runs in the background for multiple instances and performs consequential actions like sending message alerts to the customer or disseminating information to relevant departments within the firm. This frees the employee to tackle high-value tasks and boosts their overall productivity.

The Pros

We looked into RPA as a positive addition to financial crime management services because of its multi-pronged benefits. It’s viable as a complete solution, from setup to end-customer usage. First off, integrating RPA into banking does NOT require additional core infrastructure or many upgrades. The cost of implementation is limited as opposed to upgrading a legacy system, which is both expensive and risk-ridden.

The main operational advantages are of time and cost savings. RPA-integrated suites are usually designed to be user-friendly to employees with little or no coding experience. These fin-bots shoulder the burden of repetitive tasks and drive the employee morale up. They enable the firms to hire only specialized FTEs while the bots function round the clock, 365 days and continue monitoring at all times. With automatic time stamping and meta-data, it’s easy to track the data provenance and sequence of their activity.

As with any software, the code of RPA systems is easy to update and align with the evolving regulations. This ensures that yourrisk detection strategies remain current.The scalability of RPA also plays well with the unified data mapping approach.

RPA Use Cases in Bank Fraud Detection

Bank of Ceylon became the latest Clari5 partner to recognize the impact of the silo-breaking technology. Robotic Process Automation is a veritable catalyst in this type of undertaking. It has both individual/firm-level impact and country-wide implications in terms of fighting financial terrorism. Two use cases of Clari5 that stand out are:

Use Case1: Intelligent Alert Disposition

Suites that operate using Intelligent Process Automation (RPA + ML) authorize their bots to access their case management systems. The entire process from login up to resolution can be delegated to these bots. They may access the configured alerts from a queue. Based on the information, they can retrieve client ID and PAN details. This would further trigger requests to get the credit scores from external portals. Based on this score the bot might make an unsupervised closure or forward the alert to the trading team.

Given the number of transactions and the wide array of parameters that affect customer activity, this will reduce the huge workload in terms of addressing inconsequential alerts. But it also ensures that the real fraudulenttransactions are instantly spotted from a diverse dataset.

Use Case2: Enhanced Due Diligence for Trade Monitoring

With nations taking the initiative for a risk-based approach to battle financial terrorism and money laundering, RPA-integrated, cross-channel software emerges as the go-to solution. RPA bots can screen and spot high-value transactions to beneficiaries in risk countries. The transaction itself can be evaluated for potential fraud by comparing Bill of Lading to the Letter of Credit. The bots can handle these critical situations with greater accuracy and no vested interests. In fact, with the extent of insight achieved through RPA, you can check the trades made against the suppliers’ actual line of business. Given their ability to digest disorganized information from various sources, they can handle exception cases better than human employees.

The Challenges

There aren’t any notable challenges in consolidating robotic process automation into financial fraud risk management. However, the extent of its utilization depends on its successful implementation. The setup requires extensive process knowledge, technical acumen, and regular monitoring to ensure that the system delivers.

RPA is a promising participant in the surging digital transformation of financial firms. As connectivity aids more fraudulent activities, RPA-integration can ensure that the enterprises always remain two steps ahead of such attempts.The reduced process times and higher efficiency gains are extra perks. Considering the bigger picture, the virtual workforce can give banks an unbeatable competitive advantage in the market.

References:

[1]Thomson Reuters, 2016 Know Your Customer Survey

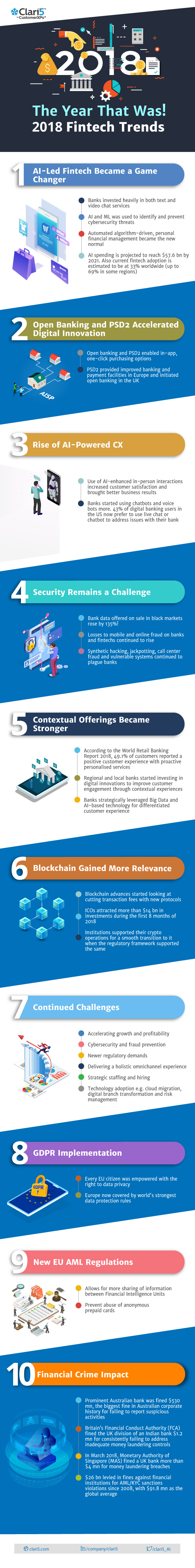

CustomerXPs has been featured in the Fintech Global RegTech 100 – a list of 100 of the world’s most innovative RegTech companies that financial institutions need to know about as they develop their RegTech strategies. The selection criteria included key factors such as impact on the problem being solved; growth in terms of capital raised, revenue, customer traction; innovation of technology solution offered; potential cost savings, efficiency improvement and revenue enhancements generated for clients; and how important is it for a financial institution to know about the company.

CustomerXPs has been featured in the Fintech Global RegTech 100 – a list of 100 of the world’s most innovative RegTech companies that financial institutions need to know about as they develop their RegTech strategies. The selection criteria included key factors such as impact on the problem being solved; growth in terms of capital raised, revenue, customer traction; innovation of technology solution offered; potential cost savings, efficiency improvement and revenue enhancements generated for clients; and how important is it for a financial institution to know about the company.