How banking fraud comes in the way of customer experience plus a few tips for superior CX.

How banking fraud comes in the way of customer experience plus a few tips for superior CX.

During the last holiday season, a third of all online purchases came from smartphone users. Just how central e-commerce and m-commerce (almost by default) has become to our way of life and how it’s expected to continue to grow is quite evident. According to Business Insider, e-commerce and m-commerce are showing no signs of stopping.

Mobile transactions are overtaking everything else at a rate faster than businesses can handle. With the number of consumers switching to digital and mobile channels growing literally by the hour, banks need to simultaneously boost their defense mechanisms to prevent e-commerce and m-commerce frauds.

In fact, real-time payment systems could very well be helping accelerate financial crime. A smarter mechanism to detect patterns and quickly form rules without the added complexity of software mutation and changes is essential for fraud threats to be preempted and prevented in real-time. Intelligent systems start from a basic rule and update these rules based on patterns detected from data, at incredible speeds.

Machine learning algorithms today can analyze petabytes of data in a matter of hours and detect patterns with very simple computations. The entire process of analyzing data and formulating rules can be tested, verified and validated, making this a very precise and accurate science that gets better with use. Read more on applying Machine Learning and AI in fraud detection.

But implementing AI and machine learning in banks has its own share of challenges –

The key to advanced fraud-detection is a departure from rule-based, non-predictive detection to a non-deterministic approach that can explore and detect hitherto unknown issues/ challenges. This approach relies on several areas of AI including machine learning, deep learning and cognitive computing. Using these techniques to quickly analyze huge amounts of data, analysts can create benchmarks of normal activity and behavior patterns.

But most importantly, ecommerce platforms, financial institutions and payments systems and must have the ability to instantly detect (and prevent) threats in real-time using contextual insights synthesized from across internal and external channels.

References:

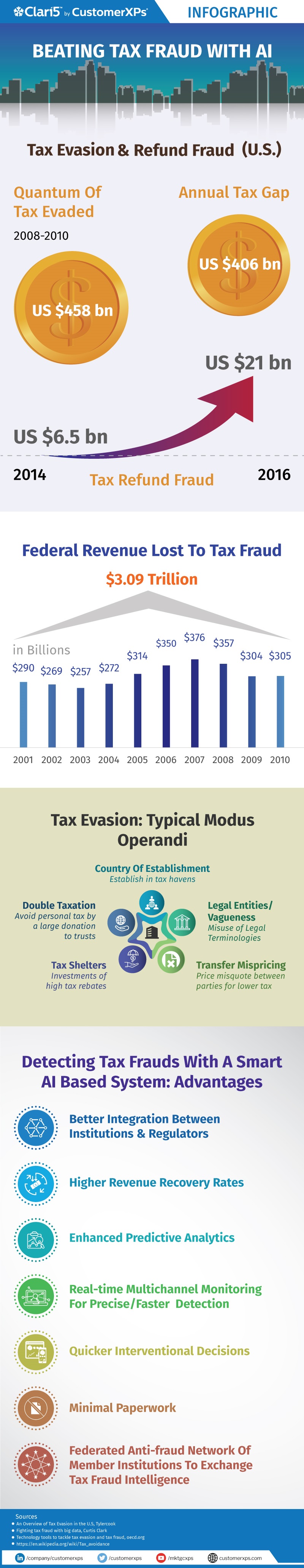

The tax frauds scenario (in the US) and how financial institutions and regulators can use an AI-based defense mechanism to combat tax dodgers.

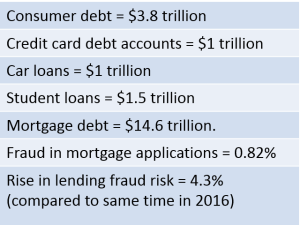

Data as of September 2017. All figures approximate. Source: 2017 Mortgage Fraud Report, CoreLogic

Data as of September 2017. All figures approximate. Source: 2017 Mortgage Fraud Report, CoreLogic

With the U.S. economy grappling with massive internal debt, ideas that can reduce even a fraction of this would be of great advantage. Financial institutions as well as startups have already begun looking for ways to innovate, and make banking systems more efficient which allows financial institutions to the lending problem effectively. Interestingly, lending can be seen as a big data problem making it naturally suited for machine learning. As part of their strategy to become efficient, profitable new age digital lenders, financial institutions can optimize their lending processes to support proactive loan decisions by leveraging AI-driven advanced analytics.

Traditional loan underwriting methods depend heavily on scores provided by credit bureaux. While credit score verification may be the first step towards filtering out likely defaulters, they could fail to capture complex patterns in loan repayments. Banks are now adopting general AI-powered tools such as chatbots, customer relationship management tools, social media footprints and real-time analytics to gauge creditworthiness more accurately.

One banking application looks at a potential applicants’ entire digital footprint to determine their creditworthiness by having individuals download their app. It looks at over 12,000 variables including social media account use, internet browsing, geolocation data, and other smartphone information. The machine learning algorithm turns all this data into a credit score, which banks and other lenders can use.

The application does not share personal data with lenders to protect individuals’ privacy but only the final result of their analysis. This has allowed their partners to approve up to 50 percent more applications. Cognitive AI applications which help students pay off their student loans faster uses machine learning to analyze the individual’s financial habits to determine if they can afford to pay back their loans faster, besides also automatically prompting how much more they should contribute.

The use of machine learning to analyze alternative data in loans and credit rating may raise some privacy, ethical, and legal concerns. People might not feel comfortable with a financial institution having access to all sensitive information about their life. Even if all these institutions behave ethically, the more data they hold the more that can be stolen by malicious hackers during a data breach.

Even with these concerns, the use of machine learning to process alternative data to determine creditworthiness will grow significantly. There are billions of people who are unbanked or with a disorderly financial spending pattern to whom financial institutions may one day offer mortgages, payment plans for products, credit cards, or other loans. The financial appeal of these tools is obvious. It is reasonable to believe that the more information you gather about an individual, the more likely you would be able to predict their behavior, including how diligently they would pay back a loan.

Most loantech applications are new and have existed during a time of modest economic growth. It is easy to appear right about loan worthiness during good times – the real test is often how they perform during a slump. Even if machine learning can accurately use an individual’s digital footprint (purchase history, app use, search history, social media activity) to determine their creditworthiness, it isn’t necessary that machine learning systems will always yield better results than traditional credit measures, unless it works in a cross-channel, real-time fashion.

There’s another important dimension – fraud.

Banks work on thin margins because of extensive regulations and operational controls and interest fees on loan/credit products is their bread and butter. So, fraud perpetrated on these products hit them quite hard. Banks are continuously challenged by fraud, a lot of which are perpetrated by unscrupulous agents who use a variety of alternate delivery channels available today. Fraud by customers who work with accomplices (other customers and /or bank employees) take advantage of limited safeguards against fraud for loan/credit products.

Also, credit departments of banks tasked with identifying / establishing customer credit-worthiness before disbursing funds, must invest more efforts in identifying account organizing frauds in real-time to handle cases internally to take quick, preventive action if/when required.

Besides helping detect fraud syndicates, AI-based, real-time, cross-channel anti-fraud technology can help decline loans or keep an eye on the borrower and restrict them or favor them according to their credit risk and fraud risk ratings.

Intelligent real-time anti-fraud solutions have comprehensive rule-based fraud identification mechanisms that enable banks to instantly identify fraudulent applications/loans/customers in real-time at the loan origination stage itself. These solutions enable banks to accelerate the entire credit processing end-to-end workflow and can be configured to perform granular pattern-matching against a large set of pre-configured variables to automate potential loan fraud scenarios.

Digital lending helps reduce conflict in the borrowing ecosystem, reduces paperwork and moves customers to online and mobile interfaces. But what will change the game will be the accurate application of customer insights (using both internal and external data) and precise digital analytics using AI and machine learning to intervene in absolute real-time.

References:

• Advanced Analytics and the future of digital lending, Jim Marous

• Artificial Intelligence Applications for Lending and Loan Management, Jon Walker

• Is AI a threat to fair lending? Penny Crosman

Real-time and near real-time payment systems have changed the very fabric of online commerce. Over 30 countries now have real-time payment processes of some kind, some of them in use since decades.

The growth in Real-time Retail Payment Systems (RT-RPS) has been encouraging, with 18 countries now having a ‘live’ RT-RPS systems in place. Additionally, 12 countries are exploring/planning/building RT-RPS systems, with another 17 exploring RT-RPS through a pan-European initiative.

Over the last year, papers on real-time payments published by the U.S. Federal Reserve Bank, the European Payments Council and the European Banking Association have created considerable interest within the banking ecosystem.

RT-RPS systems have some common characteristics, like instant clearing confirmation to support instant or near real-time posting by banks, 24/7/365 operations and a focus on richer data standards, such as ISO 20022.

In a real-time or a near-real-time environment, once the transaction is over, the money is gone, compared to traditional payment mechanisms which gave financial institutions ample time to scrutinize transactions before they were cleared. Fraudsters had to wait for the money to hit accounts before they could vanish with the loot.

By shrinking the transaction processing window, the time to detect and act on fraud is greatly diminished. So whatever the technology that is used to accelerate payments, it must also support the bank’s ability to detect and thwart fraud.

Launched in 2008, UKFP (UK Faster Payments) was one of the first of the new generation RT-RPS services. While UKFP has been a success, the potential for fraud was seen immediately. In UKFP’s first two years, fraud tripled according to behavioral biometrics firm Biocatch.

Even though the infrastructure was sound, the entry points to transaction initiation were weak, and this was exploited by fraudsters. To enhance authentication, some quick steps were taken to improve verification of customer credentials using two-factor identification, tokenization and smartcard readers.

Fraudsters today are increasingly using malware to hijack user sessions and move money quickly and automatically, forcing banks to further fortify their defense mechanisms. As countries continue to roll out faster payment systems, it would be wise to pay heed to these lessons.

Quite evidently, real-time payments calls for extreme real-time fraud detection and prevention.

Financial institutions must arm themselves with financial crime prevention capabilities that are able to detect, investigate, prevent and resolve financial crimes much more intelligently.

Faster payment services are typically available across multiple channels (IVR, online, mobile, ATM, POS, etc.), so transactions must be monitored (and anomalies acted up on) in extreme real-time and across all channels. An intelligent monitoring system must therefore cover all channels to look for undesirable patterns or deviations from a customer’s known/usual behavior.

Another critical risk in real-time payments is identity management. Multi-factor identification to confirm payment parties makes payment initiation more secure. Behavioral analytics and biometric information to combat remote access attacks and malware also add to the overall defense framework.

Besides helping real-time payment fraud prevention, detection and investigation, new age cross-channel, extreme real-time systems also address regulatory compliance and audits.

Not so long ago, fraud monitoring used to follow an ‘observe and report’ process. Global compliance efforts are now choosing to pro-actively stop transactions based on suspicious activities, before they are executed.

It has also become increasingly vital to utilize the collective, cross-channel wisdom about customers, so that even the slightest deviation during a real-time payment is detected in absolute real-time. Extreme real-time transaction monitoring enables banks to make more accurate, in-the moment, ‘segment of one’ interventions.

Constantly staying several steps ahead of sophisticated digital financial crime has become an inevitability amidst the economic and regulatory pressures challenging retail banking worldwide.

Financial institutions cannot do away with customers expecting immediate and secure real-time payment transactions. But with real-time payments increasing the vulnerability to financial crime, the situation demands more intelligent, extreme real-time and cross-channel preventive systems.

References:

• Faster Payments Equals Faster Fraud in a Real-Time World, Trevor Mast, Payments Leader

• Real-time payments: Towards speed and transparency, Payments Cards and Mobile

• Continuing the Evolution of Real-Time Payments in the U.S., VolanteTech

While it offers massive convenience, digital wallets are as vulnerable to fraud as other banking channels. Here’s an overview of the Indian digital wallets landscape with some insightful tips on reducing vulnerabilities.