[et_pb_section bb_built=”1″ admin_label=”section” inner_width=”auto” inner_max_width=”1080px”][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial” _builder_version=”4.5.3″]

Clari5’s financial institution customers are continuing to receive highly coveted acclaim from global industry bodies for adopting Clari5’s novel cross channel approach to fighting financial crime.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text use_border_color=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial” _builder_version=”4.0.10″ text_text_shadow_horizontal_length=”text_text_shadow_style,%91object Object%93″ text_text_shadow_horizontal_length_tablet=”0px” text_text_shadow_vertical_length=”text_text_shadow_style,%91object Object%93″ text_text_shadow_vertical_length_tablet=”0px” text_text_shadow_blur_strength=”text_text_shadow_style,%91object Object%93″ text_text_shadow_blur_strength_tablet=”1px” link_text_shadow_horizontal_length=”link_text_shadow_style,%91object Object%93″ link_text_shadow_horizontal_length_tablet=”0px” link_text_shadow_vertical_length=”link_text_shadow_style,%91object Object%93″ link_text_shadow_vertical_length_tablet=”0px” link_text_shadow_blur_strength=”link_text_shadow_style,%91object Object%93″ link_text_shadow_blur_strength_tablet=”1px” ul_text_shadow_horizontal_length=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_horizontal_length_tablet=”0px” ul_text_shadow_vertical_length=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_vertical_length_tablet=”0px” ul_text_shadow_blur_strength=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_blur_strength_tablet=”1px” ol_text_shadow_horizontal_length=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_horizontal_length_tablet=”0px” ol_text_shadow_vertical_length=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_vertical_length_tablet=”0px” ol_text_shadow_blur_strength=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_blur_strength_tablet=”1px” quote_text_shadow_horizontal_length=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_horizontal_length_tablet=”0px” quote_text_shadow_vertical_length=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_vertical_length_tablet=”0px” quote_text_shadow_blur_strength=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_blur_strength_tablet=”1px” header_text_shadow_horizontal_length=”header_text_shadow_style,%91object Object%93″ header_text_shadow_horizontal_length_tablet=”0px” header_text_shadow_vertical_length=”header_text_shadow_style,%91object Object%93″ header_text_shadow_vertical_length_tablet=”0px” header_text_shadow_blur_strength=”header_text_shadow_style,%91object Object%93″ header_text_shadow_blur_strength_tablet=”1px” header_2_text_shadow_horizontal_length=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_horizontal_length_tablet=”0px” header_2_text_shadow_vertical_length=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_vertical_length_tablet=”0px” header_2_text_shadow_blur_strength=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_blur_strength_tablet=”1px” header_3_text_shadow_horizontal_length=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_horizontal_length_tablet=”0px” header_3_text_shadow_vertical_length=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_vertical_length_tablet=”0px” header_3_text_shadow_blur_strength=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_blur_strength_tablet=”1px” header_4_text_shadow_horizontal_length=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_horizontal_length_tablet=”0px” header_4_text_shadow_vertical_length=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_vertical_length_tablet=”0px” header_4_text_shadow_blur_strength=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_blur_strength_tablet=”1px” header_5_text_shadow_horizontal_length=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_horizontal_length_tablet=”0px” header_5_text_shadow_vertical_length=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_vertical_length_tablet=”0px” header_5_text_shadow_blur_strength=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_blur_strength_tablet=”1px” header_6_text_shadow_horizontal_length=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_horizontal_length_tablet=”0px” header_6_text_shadow_vertical_length=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_vertical_length_tablet=”0px” header_6_text_shadow_blur_strength=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_blur_strength_tablet=”1px” box_shadow_horizontal_tablet=”0px” box_shadow_vertical_tablet=”0px” box_shadow_blur_tablet=”40px” box_shadow_spread_tablet=”0px” z_index_tablet=”500″]

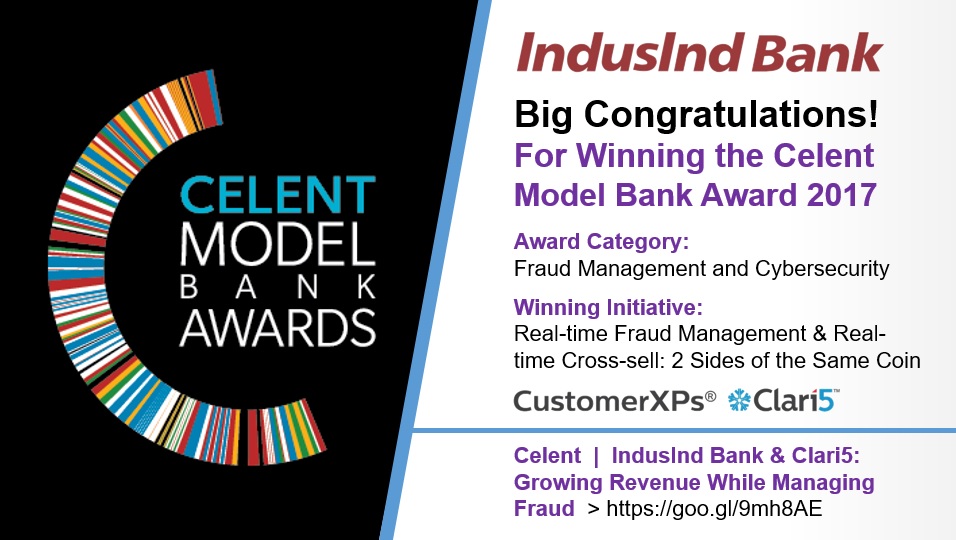

IndusInd Bank Wins ‘Model Bank’ Award

IndusInd Bank has won the Celent Model Bank of the Year Award For Growing Revenue While Managing Fraud. This is an endorsement of Clari5’s ‘Yin & Yang’ Approach to Fraud Management and Cross-sell.

Mridul Sharma, EVP & Head of Technology, IndusInd Bank said, “Clari5’s ‘central nervous system’ not only helped us prevent fraud in real-time across channels, but also delivered real-time actionable insights for cross-sell and upsell.” Read more on the

IndusInd Bank website and in

Express Computer.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

Karnataka Bank Receives Global Recognition

One of Clari5 early customers, Karnataka Bank, earned the ‘Highly Commended’ citation for ‘Best Use of IT for Risk and Compliance’ at the prestigious Banking Technology Awards in London in a glittering ceremony attended by luminaries from the global banking industry.

Karnataka Bank had also earlier won the Indian Banks’ Association (IBA)’s Banking Technology Award for Best Risk and Fraud Management’.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

Clari5 Expanding Global Footprint

Clari5 meanwhile is increasingly becoming the partner of choice for leading financial institutions. Several new banks were added to Clari5’s fast growing client roster including Philippines’ 7th largest bank and the world’s first and largest Islamic Bank. Clari5 is now present in 7 countries across North America, Africa, Middle East and Asia Pacific.

By adopting an intelligent and smart technology like Clari5, banks are able to focus on their core business instead of investing in heavy infrastructure and reduce regulator penalties for non-compliance.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

Clari5 Bags Global ‘Best Product’ Awards

Clari5 also recently bagged the Golden Globe Tigers 2017 ‘Best Banking Enterprise Fraud Management For Islamic Banking’ Award at Kuala Lumpur. Previously Clari5 had bagged the Risk.net ‘Best Fraud Detection Product Award’ – an iconic recognition that is the global equivalent of bagging an Oscar for Best Picture – in London. Read more on the

Risk.net website.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial” _builder_version=”4.5.3″]

Prominent Analyst Positioning for Clari5

Clari5’s parent company CustomerXPs was positioned in premier analyst firm Chartis’ RiskTech Quadrant on ‘Enterprise Solutions for Fraud Technology’ for market positioning and completeness of offering.

The company was also featured in Chartis’ RiskTech 100 rankings for the 3rd consecutive year.

Download the full report

here.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text use_border_color=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial” _builder_version=”4.5.3″ text_text_shadow_horizontal_length=”text_text_shadow_style,%91object Object%93″ text_text_shadow_horizontal_length_tablet=”0px” text_text_shadow_vertical_length=”text_text_shadow_style,%91object Object%93″ text_text_shadow_vertical_length_tablet=”0px” text_text_shadow_blur_strength=”text_text_shadow_style,%91object Object%93″ text_text_shadow_blur_strength_tablet=”1px” link_text_shadow_horizontal_length=”link_text_shadow_style,%91object Object%93″ link_text_shadow_horizontal_length_tablet=”0px” link_text_shadow_vertical_length=”link_text_shadow_style,%91object Object%93″ link_text_shadow_vertical_length_tablet=”0px” link_text_shadow_blur_strength=”link_text_shadow_style,%91object Object%93″ link_text_shadow_blur_strength_tablet=”1px” ul_text_shadow_horizontal_length=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_horizontal_length_tablet=”0px” ul_text_shadow_vertical_length=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_vertical_length_tablet=”0px” ul_text_shadow_blur_strength=”ul_text_shadow_style,%91object Object%93″ ul_text_shadow_blur_strength_tablet=”1px” ol_text_shadow_horizontal_length=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_horizontal_length_tablet=”0px” ol_text_shadow_vertical_length=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_vertical_length_tablet=”0px” ol_text_shadow_blur_strength=”ol_text_shadow_style,%91object Object%93″ ol_text_shadow_blur_strength_tablet=”1px” quote_text_shadow_horizontal_length=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_horizontal_length_tablet=”0px” quote_text_shadow_vertical_length=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_vertical_length_tablet=”0px” quote_text_shadow_blur_strength=”quote_text_shadow_style,%91object Object%93″ quote_text_shadow_blur_strength_tablet=”1px” header_text_shadow_horizontal_length=”header_text_shadow_style,%91object Object%93″ header_text_shadow_horizontal_length_tablet=”0px” header_text_shadow_vertical_length=”header_text_shadow_style,%91object Object%93″ header_text_shadow_vertical_length_tablet=”0px” header_text_shadow_blur_strength=”header_text_shadow_style,%91object Object%93″ header_text_shadow_blur_strength_tablet=”1px” header_2_text_shadow_horizontal_length=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_horizontal_length_tablet=”0px” header_2_text_shadow_vertical_length=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_vertical_length_tablet=”0px” header_2_text_shadow_blur_strength=”header_2_text_shadow_style,%91object Object%93″ header_2_text_shadow_blur_strength_tablet=”1px” header_3_text_shadow_horizontal_length=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_horizontal_length_tablet=”0px” header_3_text_shadow_vertical_length=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_vertical_length_tablet=”0px” header_3_text_shadow_blur_strength=”header_3_text_shadow_style,%91object Object%93″ header_3_text_shadow_blur_strength_tablet=”1px” header_4_text_shadow_horizontal_length=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_horizontal_length_tablet=”0px” header_4_text_shadow_vertical_length=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_vertical_length_tablet=”0px” header_4_text_shadow_blur_strength=”header_4_text_shadow_style,%91object Object%93″ header_4_text_shadow_blur_strength_tablet=”1px” header_5_text_shadow_horizontal_length=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_horizontal_length_tablet=”0px” header_5_text_shadow_vertical_length=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_vertical_length_tablet=”0px” header_5_text_shadow_blur_strength=”header_5_text_shadow_style,%91object Object%93″ header_5_text_shadow_blur_strength_tablet=”1px” header_6_text_shadow_horizontal_length=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_horizontal_length_tablet=”0px” header_6_text_shadow_vertical_length=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_vertical_length_tablet=”0px” header_6_text_shadow_blur_strength=”header_6_text_shadow_style,%91object Object%93″ header_6_text_shadow_blur_strength_tablet=”1px” box_shadow_horizontal_tablet=”0px” box_shadow_vertical_tablet=”0px” box_shadow_blur_tablet=”40px” box_shadow_spread_tablet=”0px” vertical_offset_tablet=”0″ horizontal_offset_tablet=”0″ z_index_tablet=”0″]

CustomerXPs Fast-tracking Growth

Given its 191% revenue growth last fiscal, CustomerXPs was featured in Deloitte’s prestigious Technology Fast500 AsiaPacific and Fast50 India listings. View the full report

here.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row admin_label=”row” background_position=”top_left” background_repeat=”repeat” background_size=”initial” width=”80%” max_width=”1080px”][et_pb_column type=”4_4″ custom_padding__hover=”|||” custom_padding=”|||”][et_pb_text background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

“This trend can be directly attributed to an increased global uptake for a unified approach to fraud management.

Our differentiated ‘human brain’ based cross-channel approach and our 100% implementation success when combined with a hyper-localized product avatar ensures global banks can go live very quickly on the smartest fraud management platform.”

-Rivi Varghese, CEO, CustomerXPs

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

London, 3 July 2017. Leading provider of real-time financial crime, risk and compliance software for the global banking sector CustomerXPs has for the 2nd consecutive year been positioned as an Enterprise Solution in the Chartis RiskTech Quadrant® for Enterprise Fraud Technology in the 2017 Financial Crime Risk Management Report.

London, 3 July 2017. Leading provider of real-time financial crime, risk and compliance software for the global banking sector CustomerXPs has for the 2nd consecutive year been positioned as an Enterprise Solution in the Chartis RiskTech Quadrant® for Enterprise Fraud Technology in the 2017 Financial Crime Risk Management Report.

Clari5 customer IndusInd Bank realized that fraud and revenue can be 2 sides of the same coin, and converted this into an opportunity. The genesis of this platform was laid when the bank recognized the importance of integrating insights from different delivery channels into a single platform. To enable real-time detection across different online channels and products, it was essential for IndusInd Bank to correlate data from multiple systems and have an integrated view. [

Clari5 customer IndusInd Bank realized that fraud and revenue can be 2 sides of the same coin, and converted this into an opportunity. The genesis of this platform was laid when the bank recognized the importance of integrating insights from different delivery channels into a single platform. To enable real-time detection across different online channels and products, it was essential for IndusInd Bank to correlate data from multiple systems and have an integrated view. [