While the generic benefits of Big Data Analytics are known, applying it in the context of banking for fraud prevention and cross-sell must be approached differently.

While the generic benefits of Big Data Analytics are known, applying it in the context of banking for fraud prevention and cross-sell must be approached differently.

How can you make your bank’s customers control transactions on their accounts and use it as an effective fraud protection mechanism? Customer communication and preferences can be vital in detecting fraud early and costs far less.

Consider the following scenarios:

In all these scenarios, the bank customers provide the vital situational intelligence which can be built into the banks’ processes for effective fraud protection. In turn, customers also benefit with the convenience of banking on their own terms and securing their accounts.

If you think this is too futuristic, you may be wrong. Reserve Bank of India’s expert committee on customer service in banking has published recommendations to this effect (Report of the committee on customer service in banks). We might see these recommendations getting implemented by Indian banks very soon.

Bank’s core system i.e. core banking, internet banking and credit card processing systems, however modern they may be, are ill-suited to handle this kind of agility. Current generation systems can at the best match a transaction to a bank maintained blacklist and stop a transaction when an entity match occurs.

Banks need to handle this using agile fraud management system which can take this situation intelligence into consideration as part of its decision making strategy for fraud protection. What banks need is a dynamic fraud management system that can digest the relevant information about the debit blocks/limit preferences customer has opted for the given time period and the same system is used for real-time fraud protection.

A real-time fraud protection system monitors every transaction and decides whether to allow, decline or challenge based on the fraud risk system inherently derives or based on the customer provided situational intelligence. This is an example of a technology that can truly achieve the dual objectives of enhanced customer experience and improved fraud control.

How do you see your institution using customer context based intelligence for better fraud prevention?

19 – 20 June, 2017

Cinnamon Lakeside, Colombo

Clari5 was a key sponsor of the Sri Lanka Association of Banking Sector Risk Professionals’ Risk Symposium 2017, held on 19 and 20 June, at Cinnamon Lakeside, Colombo. The theme of the event was ‘Risk Management for sustainable value creation’. We articulated how Sri Lankan banks can tackle the growing financial crime threat with an unconventional ‘central nervous system’ approach and shared risks related to digitization in the subsequent panel discussion on ‘quantification of risk – scenario analysis’.

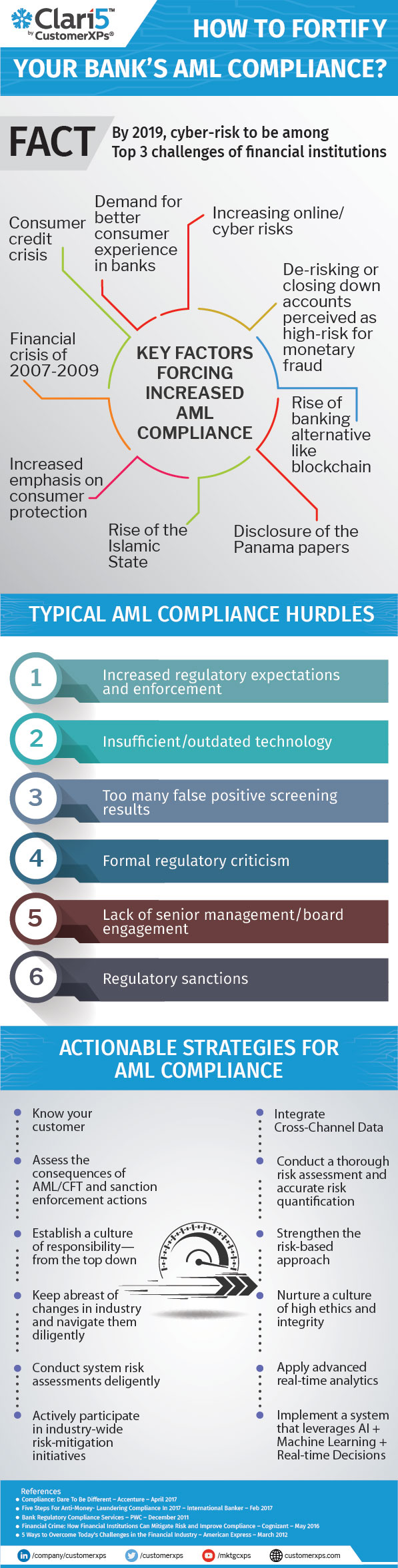

Worldwide, banks have paid over $300 billion in fines since 2008 and this number is set to increase. Regulators have been pressurizing financial institutions to follow compliances stringently and quickly. How can banks stay ahead of AML compliance curve regardless of the pace at which new regulations are issued?

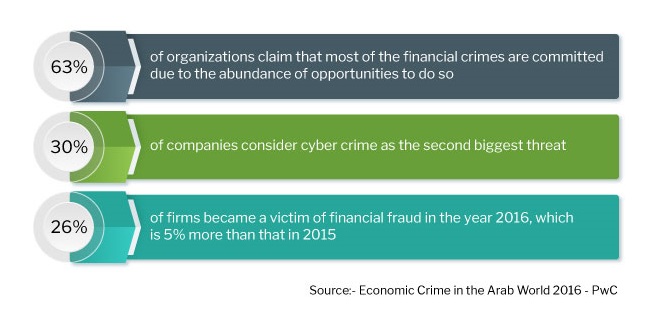

Alarming revelations on money laundering and banking frauds have emerged in recent reports by Deloitte, Thomson Reuters and PwC, who comprehensively surveyed MENA (Middle East & North Africa) nations. While the findings have helped financial institutions in improving resourcing, benchmarking and streamlining regulatory compliance, it has also highlighted certain pertinent concerns.

Here are the top five takeaways from these reports.

These facts serve as an eye-opener for financial institutions in MENA nations. With the nature of financial crimes having become more complex and difficult to detect, the time is right for re-examining current defense strategies and articulating unconventional mechanisms to prevent loss from fraud.

Time for action

Sources –

Dubai, 1-2 May 2017. Enterprise Financial Crime Management software product company CustomerXPs along with Finesse, their premier technology partner, will be showcasing their acclaimed product Clari5 at the Seamless Middle East 2017 expo scheduled to be held at the Dubai International Convention & Exhibition Centre on 1 and 2 May.

Dubai, 1-2 May 2017. Enterprise Financial Crime Management software product company CustomerXPs along with Finesse, their premier technology partner, will be showcasing their acclaimed product Clari5 at the Seamless Middle East 2017 expo scheduled to be held at the Dubai International Convention & Exhibition Centre on 1 and 2 May.

The expo is being held under the patronage of HH Deputy PM & Minister of Interior Lt. Gen. Sheikh Saif Bin Zayed Al Nahyan, and in partnership with Arab Federation for E-commerce, League of Arab States and Council of Arab Economic Unity.

Spanning over 22,500 sqm at the Dubai International Convention & Exhibition Centre, Seamless Middle East is expected to have over 400 exhibitors and over 10,000 attendees. The expo brings together the Middle East fintech ecosystem to debate and evaluate the future of money.

Across 2 days of keynotes, panels, case studies, interviews, demos, roundtables and workshops, attendees will experience the trends, disruptors and innovations that are revolutionising the Middle East fintech industry.

At Seamless Middle East, CustomerXPs will be demonstrating Clari5 – the real-time, cross-channel banking enterprise fraud management innovation declared Best Fraud Detection Product by Risk.net. Clari5 consolidates relevant intelligence from across all channels and business-critical systems of the bank to deliver real-time, contextual and actionable interventions at split-second speed.

CustomerXPs will be showcasing Clari5 at S62, Za’abeel Hall 6. The company will also be demonstrating how banks in the Middle East can combat fraud with a collaborative ecosystem and how a ‘central nervous system’ based anti-fraud shield can help Islamic Banking.

“We are definitely excited to be at Seamless once again. Banks in MENA are attracting attention from global fraudsters and hence there is a need for an ‘anti-fraud’ shield.” said Rivi Varghese, CEO of CustomerXPs. “Leading banks in MENA have already begun adopting our ‘central nervous system’ based cross-channel approach for fighting financial crime via our acclaimed Clari5 suite.”

Sunil Paul, Co-Founder & COO, Finesse added, “Our long-standing partnership with CustomerXPs for taking Clari5 to banks in MENA has proven to be a success. We expect to further consolidate Finesse’s leadership in the region with our association. Together we expect to have an impactful presence at Seamless Middle East.”

1 – 2 May, 2017

DICEC, Dubai

CustomerXPs and Finesse Showcase Clari5’s ‘Central Nervous System’ based Anti-fraud Shield for Islamic Banking at Middle East’s most prominent Summit. CustomerXPs also showed how banks in the Middle East can combat fraud with a collaborative ecosystem.

![]()

13 – 14 March, 2017

ADNEC Abu Dhabi

Featuring industry-leading conferences and a focused trade exhibition MEFTECH is the definitive fintech platform where decision-makers in MENA share insights with technology providers and collaborate to rethink financial services. At MEFTECH, CustomerXPs will enable banks in MENA to discover a whole new approach to fraud management.

IndusInd Bank has won the Celent Model Bank 2017 Global Award for Fraud Management and Cybersecurity for driving a unique initiative, namely how to leverage the investments in fraud management to pay for itself. In the innovation, IndusInd Bank not only implemented the real-time enterprise wide cross-channel fraud and AML management platform, but also began reusing in-memory data to offer simultaneous real-time cross-sell and upsell. IndusInd Bank chose the new generation enterprise approach for fraud management as against the dated and easier channel silo based approach, as it enabled a ‘segment of one’ thinking for everything in the bank and connected 15 Real-time and 7 Batch systems. Clari5 implemented a ‘central nervous system’ that revolutionized IndusInd Bank’s Fraud and AML Management in a very short period, which by itself is a commendable. This prestigious acclaim is a clear endorsement that managing fraud with disparate product and channel solutions in today’s connected digital world is no longer effective. A good fraud management system has to be enterprise wide and must operate in real-time across Products (Cards, Current Accounts, Loans, etc.), Channels (ATM, POS, Branch, Mobile, etc.), Customers, Employees and Third Parties. “Innovative fraud risk management has always been one of our top strategic priorities and so quite naturally, we are excited about this global recognition of our efforts”, said Mridul Sharma, EVP and Head of Technology, IndusInd Bank. He further added, “Clari5’s ‘central nervous system’ not only helped us prevent fraudulent transactions in real-time across channels, but also delivered real-time actionable insights for cross-sell and upsell.” “IndusInd Bank’s implementation of an enterprise-wide fraud and AML management platform is impressive in its own right. However, what really caught our eye is the bank’s innovation to enable simultaneous real-time cross-sell and upsell to customers using the same computed memory of its fraud management platform”, said Zilvinas Bareisis, senior analyst in Celent’s Banking practice. “We are convinced that other banks can learn from IndusInd about the ‘yin and yang’ of fraud management and cross-sell.” “Banking is the only industry in the world, which can claim to have the customer’s soul. However, the dated channel siloed approach for fraud bogs the bank down bigtime. Congrats to the senior management of IndusInd Bank for having the bold vision of a ‘segment of one’ enterprise wide approach. Their meticulous focus on this goal, transformed the bank, which eventually got them global kudos. Clari5 product is great because of great customers like IndusInd Bank.”, said Rivi Varghese, CEO of CustomerXPs. “It is a strong endorsement of a transformational shift from conventional, silo-based, channel-centric approach to one that recognizes fraud and revenue as two sides of the same coin.”

IndusInd Bank has won the Celent Model Bank 2017 Global Award for Fraud Management and Cybersecurity for driving a unique initiative, namely how to leverage the investments in fraud management to pay for itself. In the innovation, IndusInd Bank not only implemented the real-time enterprise wide cross-channel fraud and AML management platform, but also began reusing in-memory data to offer simultaneous real-time cross-sell and upsell. IndusInd Bank chose the new generation enterprise approach for fraud management as against the dated and easier channel silo based approach, as it enabled a ‘segment of one’ thinking for everything in the bank and connected 15 Real-time and 7 Batch systems. Clari5 implemented a ‘central nervous system’ that revolutionized IndusInd Bank’s Fraud and AML Management in a very short period, which by itself is a commendable. This prestigious acclaim is a clear endorsement that managing fraud with disparate product and channel solutions in today’s connected digital world is no longer effective. A good fraud management system has to be enterprise wide and must operate in real-time across Products (Cards, Current Accounts, Loans, etc.), Channels (ATM, POS, Branch, Mobile, etc.), Customers, Employees and Third Parties. “Innovative fraud risk management has always been one of our top strategic priorities and so quite naturally, we are excited about this global recognition of our efforts”, said Mridul Sharma, EVP and Head of Technology, IndusInd Bank. He further added, “Clari5’s ‘central nervous system’ not only helped us prevent fraudulent transactions in real-time across channels, but also delivered real-time actionable insights for cross-sell and upsell.” “IndusInd Bank’s implementation of an enterprise-wide fraud and AML management platform is impressive in its own right. However, what really caught our eye is the bank’s innovation to enable simultaneous real-time cross-sell and upsell to customers using the same computed memory of its fraud management platform”, said Zilvinas Bareisis, senior analyst in Celent’s Banking practice. “We are convinced that other banks can learn from IndusInd about the ‘yin and yang’ of fraud management and cross-sell.” “Banking is the only industry in the world, which can claim to have the customer’s soul. However, the dated channel siloed approach for fraud bogs the bank down bigtime. Congrats to the senior management of IndusInd Bank for having the bold vision of a ‘segment of one’ enterprise wide approach. Their meticulous focus on this goal, transformed the bank, which eventually got them global kudos. Clari5 product is great because of great customers like IndusInd Bank.”, said Rivi Varghese, CEO of CustomerXPs. “It is a strong endorsement of a transformational shift from conventional, silo-based, channel-centric approach to one that recognizes fraud and revenue as two sides of the same coin.”

Celent is a research and advisory firm dedicated to helping financial institutions formulate comprehensive business and technology strategies. Celent publishes reports identifying trends and best practices in financial services technology and conducts consulting engagements for financial institutions looking to use technology to enhance existing business processes or launch new business strategies. With a team of internationally based analysts, Celent is uniquely positioned to offer strategic advice and market insights on a global basis. Celent is a member of the Oliver Wyman Group, which is a wholly-owned operating unit of Marsh of Marsh & McLennan Companies [NYSE: MMC]. www.celent.com.

IndusInd Bank, which commenced operations in 1994, caters to the needs of both consumer and corporate customers. Its technology platform supports multi-channel delivery capabilities. As on March 31, 2017, IndusInd Bank has 1200 branches, and 2036 ATMs spread across 683 geographical locations of the country. The Bank also has representative offices in London, Dubai and Abu Dhabi. The Bank believes in driving its business through technology. It enjoys clearing bank status for both major stock exchanges – BSE and NSE – and major commodity exchanges in the country, including MCX, NCDEX, and NMCE. IndusInd Bank on April 1, 2013 was included in the NIFTY 50 benchmark index. Recently, IndusInd Bank ranked 13th amongst the Top 50 Most Valuable Indian Brands 2015 as per the BrandZ Top 50 rankings powered by WPP and Millward Brown.

In 2011, ICICI Bank was confronted with a unique problem. Most of the frontend staff of India’s largest private sector bank by consolidated assets were reasonably fresh, and had to be quickly trained to interact online..[Read More]

In 2011, ICICI Bank was confronted with a unique problem. Most of the frontend staff of India’s largest private sector bank by consolidated assets were reasonably fresh, and had to be quickly trained to interact online..[Read More]