Our new series of thrillers – produced and directed by CustomerXPs and Banking Technology – narrate the tales of the fight between the forces of good (the Clari5 analytics and anti-fraud software) and the forces of evil. Based on real events and guaranteed to keep you on the edge of your seat!

May of the current year.

Her addiction was getting the better of her. “Absolutely Irresistible”, the new fragrance from Givenchy, was calling out to her. And those gorgeous Prada shoes had been winking at her from the shop front for the last three weeks.

Her addiction was getting the better of her. “Absolutely Irresistible”, the new fragrance from Givenchy, was calling out to her. And those gorgeous Prada shoes had been winking at her from the shop front for the last three weeks.

“Man, I could kill for those.” “It’s been a while; I really need to find the dosh.”

Georgina bit her lower lip with these thoughts swirling in her head like the steam from her coffee. She looked at the accounts’ list. Could she get a hold of one “dormant” account?

“Can Lady Luck please be kind? Am desperate, please!”

“Hey Georgina, how’s it going? Getting used to retail banking?”

“Hi Mark. Yeah, it’s different from corporate banking for sure. I miss the thrill of big numbers. That rush of working with millions instead of thousands. Ha ha ha.”

“Hmm. So no new Gucci bag or a Marc Jacobs watch? The shops must be crying out for Your Shopaholic Majesty to give them time of day.”

“Mmm….yes, it’s been a while. Thanks for reminding me, must rectify that soon. He he.”

Mark shrugs, gives a wry smile, a quizzical look and walks away.

She paused mid-way while taking a huge bite from her BLT sandwich. Her eyes widened. The $25,000 winked at her seductively. Money was her one and only love, her manna. She quickly hit her keyboard. Joshua Hamilton, checking account, “dormant”.

Was this her lucky day or what?

Georgina pushed her sandwich aside and quickly hit a few keys. “Active” flashed on her monitor. Joshua Hamilton was now “active”.

“Gucci, Prada, Jimmy Choo, here I come… yoo hoo!” Georgina thought to herself. A wicked smile, a faraway look and Georgina was revelling in the idea of big numbers. Her heart was thumping with excitement.

“It’s going to happen. Finally. I can sleep at night and don’t need any Xanax.”

Clari5 was rifling through the list of accounts doing its customary check. Sorting accounts by status, keeping a watchful eye on transactions by account holders and being its usual Poirot self – generally keeping an eagle eye on the safety and security of data, accounts, transactions and more.

Next, next, next, next, pause! Joshua Hamilton – active. Wait, hang on. Clari5 does an about take. Pause.

Quick flashback to April last year.

Joshua Hamilton was thrilled with life. It seemed to be going as per plan. New job, new city, new role, new life. Whoa!

He had to wind up his life in New York. Give up his apartment, sell his car, get rid of the furniture, among other things. But he decided to retain his bank account. Maybe it was for sentimental reasons, maybe it was just the idea of having monies in an account which he could use during emergencies, he didn’t close the account. He had $25,000 in that account. It felt good to have that kind of money.

His new firm thought it’d be ideal if Joshua opened a salary account with the bank they banked with. Apparently this bank had fantastic services – great paybacks on savings and good customer service as a local bank. Joshua thought why not, and opened a salary account with this new bank.

The $25,000 in his NY bank grew a little more, with interest etc. Zero transactions, zero withdrawals, zero anything. It was “dormant” but doing good.

Cut to present day.

Eyes follow her slow, shamefaced, hand-touching-chin movement out of the office as colleagues stare. Cops behind, cops in front. Her mascara is runny and covers her cheeks like ski tracks on Aspen.

Georgina bites her lips in regret. If only Clari5 hadn’t sounded the alarm, if only it wasn’t so darned smart, if only it didn’t keep track of every financial and non-financial transaction, she’d be wearing her Guccis today and looking like a million bucks. Even Xanax or Prozac wouldn’t be able to help her now, not in a prison cell for sure.

Damn Clari5!

When Joshua Hamilton’s “dormant” account status became “active”, it was instantly marked as suspect, when for over a year there were no transactions on his account.

When Georgina initiated a $10,000 encashment on this account using a withdrawal receipt forged with Joshua’s signature, Clari5’s real-time decisioning engine noted this.

The potential fraud transaction was blocked and generated an alert in the case management system.

And a case of deceit and willful defraudment is slapped on Georgina.

Episode 1: Malafide Intentions

Episode 2: Blacklisted

Episode 4: Money Rolls

How To Monetize your Anti-Fraud Solution to Make Money for your Bank

How To Monetize your Anti-Fraud Solution to Make Money for your Bank ‘Money Rolls’

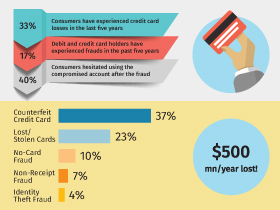

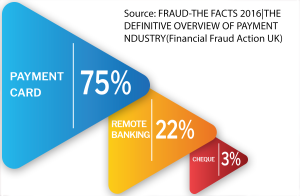

‘Money Rolls’ Infographic: Credit Card Frauds 101

Infographic: Credit Card Frauds 101 Clari5 Case Study: Real-time AML for Prominent Bank

Clari5 Case Study: Real-time AML for Prominent Bank

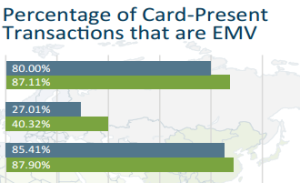

When it comes to EMV standard, although the card data will be the same for every transaction, there will also be other pieces of data that gets re-organised for every transaction. This renders the data stolen at the POS useless for further use.

When it comes to EMV standard, although the card data will be the same for every transaction, there will also be other pieces of data that gets re-organised for every transaction. This renders the data stolen at the POS useless for further use. Using EMV technology for cards has seen a reduction in skimming-type attacks, but the crime rate has increased in other ways of stealing money. Research firm Aite Group reports that losses from counterfeit, lost, and stolen cards in Canada dropped from $245 million in 2008 to $112 million in 2013.

Using EMV technology for cards has seen a reduction in skimming-type attacks, but the crime rate has increased in other ways of stealing money. Research firm Aite Group reports that losses from counterfeit, lost, and stolen cards in Canada dropped from $245 million in 2008 to $112 million in 2013.

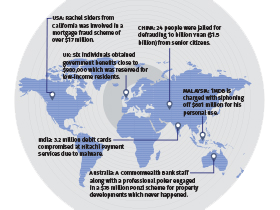

Financial Fraud: Greatest Hits of 2016

Financial Fraud: Greatest Hits of 2016 Digital Finance: What’s Next?

Digital Finance: What’s Next?

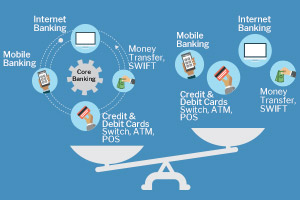

In Chinese philosophy, yin and yang (also yin-yang or yin yang, ‘dark-bright’) explains how seemingly opposite or contrary forces may actually be complementary, interconnected, and interdependent in the natural world.

In Chinese philosophy, yin and yang (also yin-yang or yin yang, ‘dark-bright’) explains how seemingly opposite or contrary forces may actually be complementary, interconnected, and interdependent in the natural world.

The solution can use the same data captured per transaction and analyze the spending and behavior patterns to throw up potential cross-sell and up-sell scenarios in absolute real-time.

The solution can use the same data captured per transaction and analyze the spending and behavior patterns to throw up potential cross-sell and up-sell scenarios in absolute real-time. While there may not be many solutions that have the ability to see topline and bottom-line as 2 sides of the same coin, CustomerXPs’ Clari5 seems to one. Its unified fraud management platform leverages the same context-aware, real-time decisioning to enable real-time customer cross/upsell.

While there may not be many solutions that have the ability to see topline and bottom-line as 2 sides of the same coin, CustomerXPs’ Clari5 seems to one. Its unified fraud management platform leverages the same context-aware, real-time decisioning to enable real-time customer cross/upsell.

Her addiction was getting the better of her. “Absolutely Irresistible”, the new fragrance from Givenchy, was calling out to her. And those gorgeous Prada shoes had been winking at her from the shop front for the last three weeks.

Her addiction was getting the better of her. “Absolutely Irresistible”, the new fragrance from Givenchy, was calling out to her. And those gorgeous Prada shoes had been winking at her from the shop front for the last three weeks.

Article: Blacklisted

Article: Blacklisted Instant Charge Recovery with the Real-Time Tool That Top Banks Trust

Instant Charge Recovery with the Real-Time Tool That Top Banks Trust Paper: Will EMV Standards Impact Fraud Control?

Paper: Will EMV Standards Impact Fraud Control? Case Study: Real-time Cross-Channel Transaction Monitoring & Fraud Management for Top 5 Bank

Case Study: Real-time Cross-Channel Transaction Monitoring & Fraud Management for Top 5 Bank

Financial institutions used to be the last candidates for change when it came to technology adoption. But over the recent past the banking sector has seen a dramatic ‘digital’ transformation given a discerning and demanding ‘digital’ generation, ferocious competition and a briskly evolving regulatory landscape.

Financial institutions used to be the last candidates for change when it came to technology adoption. But over the recent past the banking sector has seen a dramatic ‘digital’ transformation given a discerning and demanding ‘digital’ generation, ferocious competition and a briskly evolving regulatory landscape. Many ‘progressive’ banks have gradually unified their entire IT ecosystem to harness the capabilities of big data analytics.

Many ‘progressive’ banks have gradually unified their entire IT ecosystem to harness the capabilities of big data analytics. The soul analogy also applies perfectly in combating sophisticated financial fraud, where deviations and discrepancies can be detected and resolved ‘intelligently’ in the blink of an eye.

The soul analogy also applies perfectly in combating sophisticated financial fraud, where deviations and discrepancies can be detected and resolved ‘intelligently’ in the blink of an eye.

Enter EMV and NFC

Enter EMV and NFC

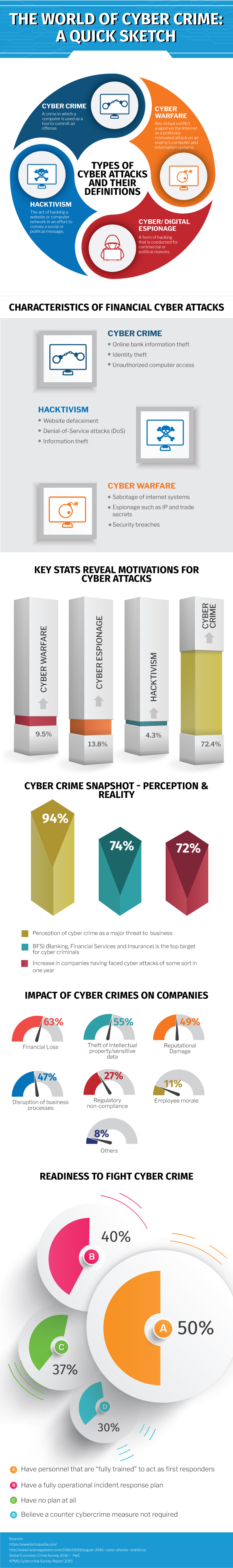

Gone are the days when ski-masked felons would barge into banks with guns cocked and order everyone to get down. With the internet becoming ubiquitous and as banks and technology have evolved, so has financial crime.

Gone are the days when ski-masked felons would barge into banks with guns cocked and order everyone to get down. With the internet becoming ubiquitous and as banks and technology have evolved, so has financial crime. What is a SWIFT Code?

What is a SWIFT Code? Banks or SWIFT – where does the onus lie?

Banks or SWIFT – where does the onus lie? What else can banks do?

What else can banks do? While financial institutions, networks such as SWIFT, regulators and policy makers are aware of the systemic gaps, radically more stringent lines of defence will be the shape of things to come. Heists, laundering and other frauds will continue to occur as hackers get more brazen, but the least banks can do is have foresight on the magnitude of the problem and take sure steps to secure themselves.

While financial institutions, networks such as SWIFT, regulators and policy makers are aware of the systemic gaps, radically more stringent lines of defence will be the shape of things to come. Heists, laundering and other frauds will continue to occur as hackers get more brazen, but the least banks can do is have foresight on the magnitude of the problem and take sure steps to secure themselves.