[two_third_last] The larger the digital economy, the more the need for smarter fraud risk management solutions. AIM lists 5 five new-age firms with advanced analytics-based solutions to fight fraud and business risk. Read More

The larger the digital economy, the more the need for smarter fraud risk management solutions. AIM lists 5 five new-age firms with advanced analytics-based solutions to fight fraud and business risk. Read More

Author: Clari5

Clari5 Positioned Category Leader for AML Solutions in Chartis Research Report on KYC/ AML Software Solutions

Chartis Research’s latest report provides an overview of trends in financial crime compliance systems that include KYC and AML capabilities.

Chartis Research’s latest report provides an overview of trends in financial crime compliance systems that include KYC and AML capabilities.

A key takeaway is the growing number of vendors in the space, and the increasing number of category leaders, as a result of specialist vendors emerging and consolidating their position in the AML space, and the growth of competitors challenging the dominant players. For challengers, the key capabilities are typically transaction monitoring and case management. Vendors in the category leader quadrant also represent a wider variety of geographies.

The report positions the AML solution vendors as ‘Best of Breed Solutions’, ‘Point Solutions’, ‘Enterprise Solutions’ and ‘Category Leaders’ based on market potential and completeness of offering. Clari5 is positioned as a ‘Category Leader’ in the RiskTech Quadrant for AML solutions, 2020. Download the report

Clari5 eBook: Top 10 Fraud Threats Impacting Banks

September 2020 Issue

August 2020 Issue

Ciao Dear Cheque! By when will the brave survivor of the digital era depart?

Sir Isaac Newton was still in school and yet to discover the law of gravity when in February 1659, the world’s very first cheque was written by a Mr. Vanacker for £400, payable to a Mr. Delboe drawn on London bankers Morris & Clayton. The cheque (or check, US) would go on to become one of the most important instruments for money transfer for over three centuries.

Cut to the beginning of the last decade when the cheque began going through an existential crisis. With the rise of digital banking and instant, convenient electronic payment options, the big question was why have the cumbersome process of issuing and clearing cheques to transfer funds. With digital payments rapidly creating a cashless economy, the cheque has begun heading for the exit door.

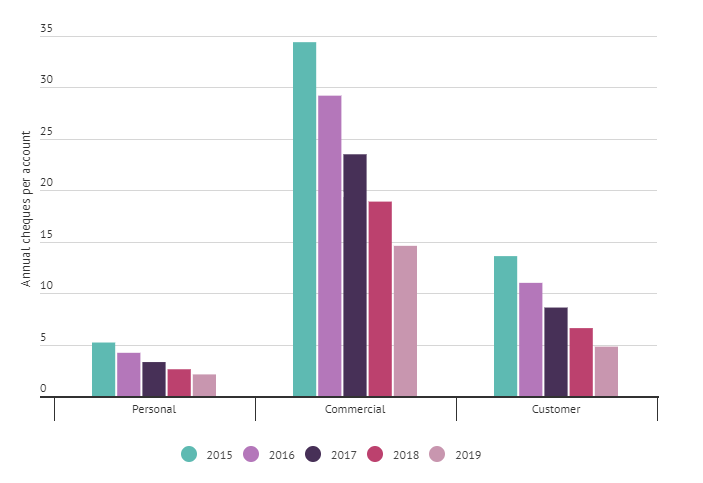

Global cheque use, Source

But there are vast populations that still rely on cheques for transferring funds, so a complete shift to a cashless/paperless economy & society is still a little away. Let’s take a quick look at a few large nations, to see where they are in phasing out cheques.

Cheque Usage in the US, the UK and Australia

There has been a noteworthy drop in cheque usage in the US and it can be ascribed to the spike in non-cash payments. In 2018, the total number of core non-cash payments was 174.2 billion (an increase of 30.6 billion from 2015). The total value of these payments was $97.04 trillion in 2018 (an increase of $10.25 trillion from the year 2015).

Total card payments, which includes both credit and debit card, also substantially grew in usage. It made up 75.3 % of the total value of payments made in 2018 (Federal Reserve). Naturally, as card payments became more popular, the usage of cheques in the US fell sharply. At the start of the century, in 2000, 42.6 billion cheque payments were made (Federal Reserve). But a decade later, it had fallen to 20 billion (The Atlantic). Today, the number has fallen further to about 14 billion and it continues to decline.

The UK meanwhile continues to use more cheques than most countries in the world. Despite having a significantly smaller population, the UK still uses a vastly greater number of cheques. In 2018, the UK used 342 million cheques (UK Finance). While this sounds like an enormous number of cheques to be cashed in a single year, it is nothing compared to the whopping 4 billion cheques that the UK cashed in 1990 (The Guardian).

Australia too has begun the process of phasing out cheques as a means of transferring funds from bank accounts. However, this is happening at a much faster rate compared to other countries. In Australia, digital payments have caused a massive decline in the total number of cheques that are being processed in the country. The total amount of payments attributed to cheques is only a tiny fraction of what it was a decade ago. Financial analysts have predicted that the total cheque value processed in Australia by 2030, will be zero (Blue Notes).

What is Fueling the Trend?

Banking is one of the oldest businesses in the world. Just like the big ideas, innovations and technology that have changed and shaped every other sector, financial services too have undergone gigantic transformations over the years.

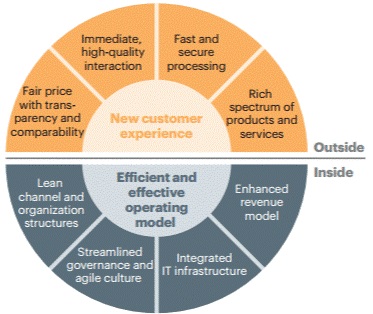

Today, there’s a growing tribe of digital competitors offering customers excellent digital-first alternatives to traditional banking organizations. While the trend is occurring around the globe, the pace has been a bit slower in the US because the financial infrastructure is proving to be an impediment to newcomers. But despite a slower rate of growth, innovative start-ups have been successful in shaking up the transaction accounts market.

According to KPMG, investment in US fintech start-ups in 2018 was about $52.5 billion (NS Banking). With enough funds at their disposal, these mavericks have been challenging the status quo.

Many of these fintechs offer fee-free usage of their online services, which means no extra charge for overdrafts and foreign transactions. This is particularly appealing to the average American household because they have to pay about $329 in bank fees to their existing financial service providers (NS Banking), one of the key factors why many customers have welcomed the transition to digital banking.

-

- Simplicity, Speed, Service – More people are making the switch to digital financial services because it is easier than ever before to transact from any place, any time. Lines in bank branches are now much shorter. Making payments with cards have become virtually effortless. Customers don’t have to remember pins and they can transfer funds using their phones. Enterprise-wide digitization has made customer service more real-time, cohesive and convenient.

Digital offers best of both worlds, Source

-

- Cost – Cheque payments also mean additional cost and administrative time and effort. A substantial amount of time is spent locating payee addresses, calculating bank charges, postage, monitoring cheque stock and printing materials. Plus, the cost implications for returned and stopped cheques due to processing errors.

-

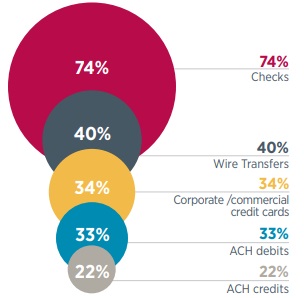

- Security – Even as banks are investing more in digital technologies to fortify anti-financial crime defenses, the Association for Finance Professionals’ Payments Fraud Survey, 2020 reveals that cheques are the most common payment method for payments fraud in the US and 74% of the companies impacted by payments fraud fell victim to cheque fraud. With advancements in technology, businesses are able to eliminate cheque fraud besides accelerating payments and account reconciliation.

Payment methods that were targets of attempted / actual payments fraud in 2019 (% of organization), Source

Businesses have begun using more efficient and secure AP automation processes to manage their payables and guarantee better ROI, but a few challenges remain. Migration to fully-automated processes for electronic B2B payments including AP and reconciliation remain disjointed. Smaller businesses find it challenging when financial service providers offer automated payment services only to larger corporate clients.

Given the variety, convenience, affordability and flexibility of service offerings in payments bank transfer solutions, accounting platforms and digital wallets, there is a growing preference for cloud services.

A survey of 1000 businesses in 2015 by the Cheque & Clearing Company, UK showed that more than 50% of those surveyed are still making and receiving payments by cheque.

- 30% said they have always used cheques

- 29% said managing cash flows was easier with cheques

- 25% said cheque payment was requested by the payee

- 21% said money leaves their account slowly when processed via cheques

Many businesses are using cheques to their advantage because cheques can take 5 days or more to clear. This gives ‘delaying’ advantage to smaller businesses that require making payments before having the funds to do so.

There’s also mobile cheque imaging which allows consumers and small business owners to take photos of cheques using smartphones and deposit them without having to go to the bank. This helps small businesses and consumers who don’t wish to breakup with their cheque books yet.

While the usage of cheques has fallen dramatically over the last decade, older customers and smaller businesses continue to stand by the cheque. The payments industry had said in the early 2000’s that cheques would go away by late 2018. Many had protested then saying cheques must not be phased out until there was a suitable alternative for people who are not comfortable switching to new technologies. Security issues with new technologies are a concern as many fear a clean-up of their accounts if tech-savvy fraudsters gain access to their phones or cards.

How much longer will the cheque be around?

It is only a matter of time before the cheque becomes a museum attraction.

With banks in the process of phasing out cheques while increasing the scope of digitization, businesses and individuals still reliant on cheques for making payments have no choice but to adapt.

Fortunately, digital transformation in banking has made it easier to switch from traditional channels. Interestingly, the number of older individuals and smaller businesses switching to online banking has been rising rapidly.

The ongoing pandemic situation is another critical factor that has accelerated the cheque’s departure, with a substantial number of people worldwide opting for cashless, contactless, paperless transactions.

There will still be certain pockets of economies, regions, businesses and customers who will continue to be loyal to the good old cheque till its phased out. Until then, they must have the choice to opt for payment methods that best suit their preferences and requirements, regardless of the relentless march of technology.

Technology on the other hand must be inclusive, so that it addresses these needs while ensuring fantastic customer experiences.

In the meantime, life goes on before another legend gets ready to walk into the sunset.

References

Association for Financial Professionals: Payments Fraud & Control Survey 2020

Blue Notes: Time to Cheque Out

The Atlantic: The Spectacular Decline of Checks

Cheque & Credit Clearing Company: Cheques Market Research

Federal Reserve: Payments Study 2019

UK Finance: Payments Market Report 2019

July 2020 Issue

Going Live: How Some Banks are Dealing with Remote Implementation

What is the safest way for banks to go live with new tools in the height of a global pandemic? Remotely, of course! This is the reality that many banks and third party providers have faced over the past few months. Despite the complications that COVID-19 has brought to banking operations, many are moving full speed ahead on projects.Read More

What is the safest way for banks to go live with new tools in the height of a global pandemic? Remotely, of course! This is the reality that many banks and third party providers have faced over the past few months. Despite the complications that COVID-19 has brought to banking operations, many are moving full speed ahead on projects.Read More

CWG Inks Strategic Partnership with Clari5 to Help African Banks Combat Financial Crime in Real-Time

Leading African IT company CWG, has partnered Clari5 to jointly help African banks combat enterprise fraud and money laundering. Through this strategic partnership, CWG and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise-wide fraud risk management capability.Read More

Leading African IT company CWG, has partnered Clari5 to jointly help African banks combat enterprise fraud and money laundering. Through this strategic partnership, CWG and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise-wide fraud risk management capability.Read More