In today’s hyper-connected financial ecosystem, fraudsters are faster, smarter, and more tech-enabled than ever—leveraging digital channels, social engineering, automation, and deepfakes to breach even the most fortified systems.

Every second, financial institutions lose millions to evolving fraud tactics. Traditional frameworks, designed for linear, siloed threats, are simply no match for today’s dynamic threatscape.

To stay ahead, financial institutions must embrace a next-generation fraud risk management approach—one that is real-time, intelligent, adaptive, and end-to-end.

Here are 25 key tenets that define the architecture of a future-ready fraud defense.

I. Comprehensive Coverage Across the Banking Landscape

1. Cover the Full Fraud Spectrum: Internal & External

Detect both internal threats (e.g., employee collusion) and external attacks (e.g., cybercriminals, fraud rings).

2. Secure All Channels: Physical & Digital

From branches and ATMs to mobile apps and call centers, fraud risk spans all touchpoints.

3. Watch Over Assets & Liabilities

Fraud impacts everything—credit, deposits, loans, and insurance. The monitoring net must cover the entire banking book.

4. Scale Across Segments: Retail & Corporate

Retail and corporate customers present different risks. Systems must adapt to both high-volume and high-value environments.

5. Monitor Beyond Transactions

Profile changes, device registrations, and login attempts often precede fraud. Monitor every interaction.

6. Understand the Nuance: Fraud vs Scam

Fraud is unauthorized; scams are deceptive. Systems must detect both scenarios distinctly.

7. Identify Victims & Villains

Distinguish between innocent victims and customers complicit in fraud (e.g., mule accounts).

8. Monitor Inbound & Outbound Flows

Unusual credits and debits—both directions matter. Inflows can signal mule activity or layering schemes.

II. Real-Time, Intelligence-Driven Defense

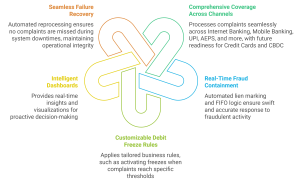

9. Combine Real-Time Monitoring with Prevention

Don’t just detect—prevent. Systems must intervene before fraud succeeds.

10. Blend Automation with Human Oversight

Automated holds and alerts must support—not replace—fraud analyst judgment.

11. Protect Onboarding & Transactions

Fraud starts at account creation. Secure onboarding is as critical as monitoring transactions.

12. Evaluate Entity & Transaction Risk Together

Who is acting and what they’re doing—context matters for better risk decisions.

13. Mix Known Patterns with ML Insights

Blend rule-based logic with machine learning to catch both familiar and novel fraud scenarios.

14. Use Gen AI for Investigations and Strategy

Accelerate decisions with Gen AI—summarize histories, suggest next steps, and design new detection paths.

15. Make Real-Time Decisions at Scale

Next-gen systems must handle 10,000+ TPS and deliver sub-second decisions—critical for real-time payments.

III. Infrastructure, Intelligence & Operational Agility

16. Ensure Compliance & Collaborate

Stay compliant and work with regulators, fintechs, and peer banks to share intelligence and reduce ecosystem risk.

17. Be Cloud-Ready (and Hybrid-Capable)

Deploy on-prem or in cloud—systems must be scalable, resilient, and flexible to support hybrid environments.

18. Leverage Internal & External Intelligence

Fuse in-house data with external watchlists and fraud consortiums for 360° risk views.

19. Analyze Both Data & Documents

Fraud hides in invoices, IDs, and contracts. Use OCR, NLP, and image analytics to surface threats.

20. Use Both Brains: Fast & Deep Thinking

Right brain: Act instantly using available real-time data.

Left brain: Apply historical analytics to uncover slow-building threats.

21. Empower Analysts with No-Code Interfaces

Let fraud teams write and test rules without coding—speed matters in evolving threat landscapes.

22. Enable Fast Integrations Across Systems

Support real-time and batch data ingestion from all banking systems for complete visibility.

23. Unify Fraud & AML Risk Views

Fraud and money laundering are often interconnected. A shared platform helps detect the full spectrum.

24. Continuously Optimize to Reduce False Positives

High false positives = customer frustration. Use feedback loops, tuning, and adaptive models to improve accuracy.

25. Adopt Identity-Centric Risk Assessment

Assess risk not just at transaction level—but at the identity level. Use behavioral biometrics, device fingerprinting, and digital identity linkage to flag fraud before it happens.

The Road Ahead

Fraud risk management is no longer a back-office function—it’s central to customer trust, regulatory standing, and business resilience.

Financial institutions that embed these 25 tenets will go beyond detection—they will build proactive, intelligent, and future-ready fraud defenses.

They’ll not only stop fraud but win trust, loyalty, and leadership in an increasingly high-risk world.

Gijima, leading South African ICT company partners with Clari5 to jointly help African banks combat real-time cross channel enterprise crime management. Through this strategic partnership, Gijima and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise fraud risk management capability.

Gijima, leading South African ICT company partners with Clari5 to jointly help African banks combat real-time cross channel enterprise crime management. Through this strategic partnership, Gijima and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise fraud risk management capability.