We are excited to share that IBM LinuxONE Emperor 4 will be available globally on September 14, 2022, and Clari5 clients will have the opportunity to reduce energy consumption while reaching sustainability targets. IBM and its partners are helping clients, including those in regulated industries such as financial services, build a modern environment that is designed to improve business agility and reduce overall costs. ISVs can leverage the next generation of IBM LinuxONE’s highly secured and sustainable platform to deploy software across environments.

Banks today are overwhelmed by the number of delivery channels they need to manage. To provide a stellar digital experience, a predictable and seamless digital experience across channels is key. Banks must examine the roadblocks in the user’s path to a consistent experience and access to information across all channels. In response, banks have been heavily investing in digital transformation to achieve key objectives, including:

- Real-time approach to monitor and detect suspicious money laundering transactions

- Improved regulatory compliance and customer confidence

- Quicker implementation because of pre-packaged AML scenarios and built-in interfaces for integration

- Scalable, compute intensive infrastructure leading to reduced TCO

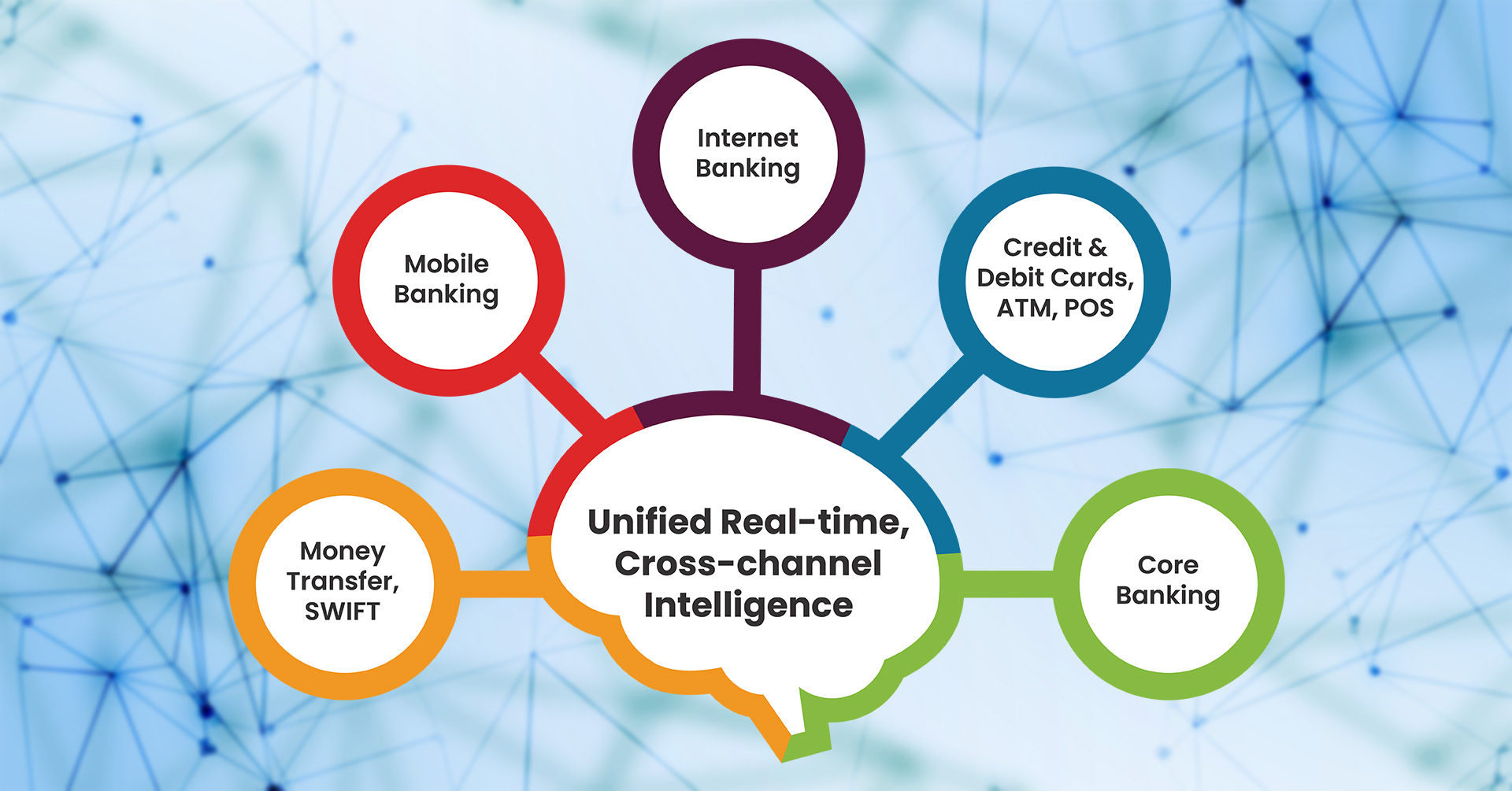

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain.

- Clari5 real-time intelligence solutions are deployed enterprise wide in some of the biggest global banks.

- Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

- Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise-wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction or generate real-time alerts for manual investigation.

Deployed on IBM LinuxONE and Linux on IBM zSystems, Clari5 solutions offer a wide spectrum of cross-channel and cross-product capabilities with ease of integration using a variety of mechanisms and pre-built connections.

About IBM LinuxONE Emperor 4

According to an IBM IBV study, almost half (48 percent) of CEOs surveyed across industries say increasing sustainability is one of the highest priorities for their organization in the next two to three years. However, more than half (51%) also cite sustainability as among their greatest challenges in the next two to three years, with lack of data insights, unclear ROI, and technology barriers, as hurdles.

The new IBM LinuxONE Emperor 4 is an enterprise server designed to help reduce energy consumption. For example, consolidating Linux workloads on five IBM LinuxONE Emperor 4 systems instead of running them on compared x86 servers under similar conditions can reduce energy consumption by 75%, space by 50 percent, and the CO2e footprint by over 850 metric tons annually.[1] Integrations with energy monitoring tools on the server also enable clients to track energy consumption.

Built on the IBM Telum Processor, IBM LinuxONE Emperor 4 supports data serving, core banking and digital assets workloads and is a platform of choice for organizations that value sustainability and security.

Partners with IBM Ecosystem

As a part of the IBM Ecosystem, Clari5 is helping companies unlock the value of cloud investments by implementing the tools and technologies that can help them succeed in a hybrid multicloud world. We are excited to be working closely with the IBM Ecosystem to bring new innovation to our clients. Based on Linux, customers can benefit from open standards and an ecosystem that IBM LinuxONE offers including modern DevOps and a variety of popular software. This can also help to remove operational barriers when customers deploy and manage technologies on cloud-native infrastructure.

1 Disclaimer: Compared 5 IBM Machine Type 3931 Max 125 model consists of three CPC drawers containing 125 configurable cores (CPs, zIIPs, or IFLs) and two I/O drawers to support both network and external storage versus 192 x86 systems with a total of 10364 cores. IBM Machine Type 3931 power consumption was based on inputs to the IBM Machine Type 3931 IBM Power EstimationTool for a memo configuration. x86 power consumption was based on March 2022 IDC QPI power values for 7 Cascade Lake and 5 Ice Lake server models, with 32 to 112 cores per server. All compared x86 servers were 2 or 4 socket servers. IBM Z and x86 are running 24x7x 365 with production and non-production workloads. Savings assumes a Power Usage Effectiveness (PUE) ratio of 1.57 to calculate additional power for data center cooling. PUE is based on Uptime Institute 2021 Global Data Center Survey (https://uptimeinstitute.com/about-ui/press-releases/uptime-institute-11th-annual-global-data-center-survey ). CO2e and other equivalencies that are based on the EPA GHG calculator (https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator ) use U.S. National weighted averages. Results may vary based on client-specific usage and location.

You can find additional resources about IBM LinuxONE Emperor 4 and IBM below:

The Middle East’s data protection regulatory landscape continues to evolve with Saudi Arabia’s newly published Personal Data Protection Law (PDPL) – a first of its kind mandate. The new regulation urges organisations, especially banks, to be responsible custodians of their customers’ data and automate privacy and security operations. To operationalise compliance, banks need to first have in place a real-time, enterprise-wide customer intelligence framework to keep pace with the current digital landscape.

The Middle East’s data protection regulatory landscape continues to evolve with Saudi Arabia’s newly published Personal Data Protection Law (PDPL) – a first of its kind mandate. The new regulation urges organisations, especially banks, to be responsible custodians of their customers’ data and automate privacy and security operations. To operationalise compliance, banks need to first have in place a real-time, enterprise-wide customer intelligence framework to keep pace with the current digital landscape.