Clari5 ‘Central Nervous System’ for combating fraud + growing revenue

Banking Solutions

‘Human brain’ like approach for global banks to fight fraud and grow revenue

Banking is the only industry where the entire life of the customer flows through it. A bank knows how much its customers earn, where they live, where they travel to, how much they spend, who’s part of the family, whether they own their home, even how much fuel they put in the car. No other industry (not even telco or retail) has the privilege of having a 360° view of a customer’s life. So, only banks have this ability to actually convert their ‘resident intel’ to their advantage.

This should ideally make banking the smartest industry on the planet, but banks are yet to realize this potential. They still believe they are in the transactions business, because of which every decision is siloed. These siloed decisions are proving costly and is impacting both the top line and bottom line of banks. Banks must use the collective insight they have gained about every individual customer and bring it to act in the split second when the transaction occurs – to influence, modify or stop the transaction across channels in real-time.

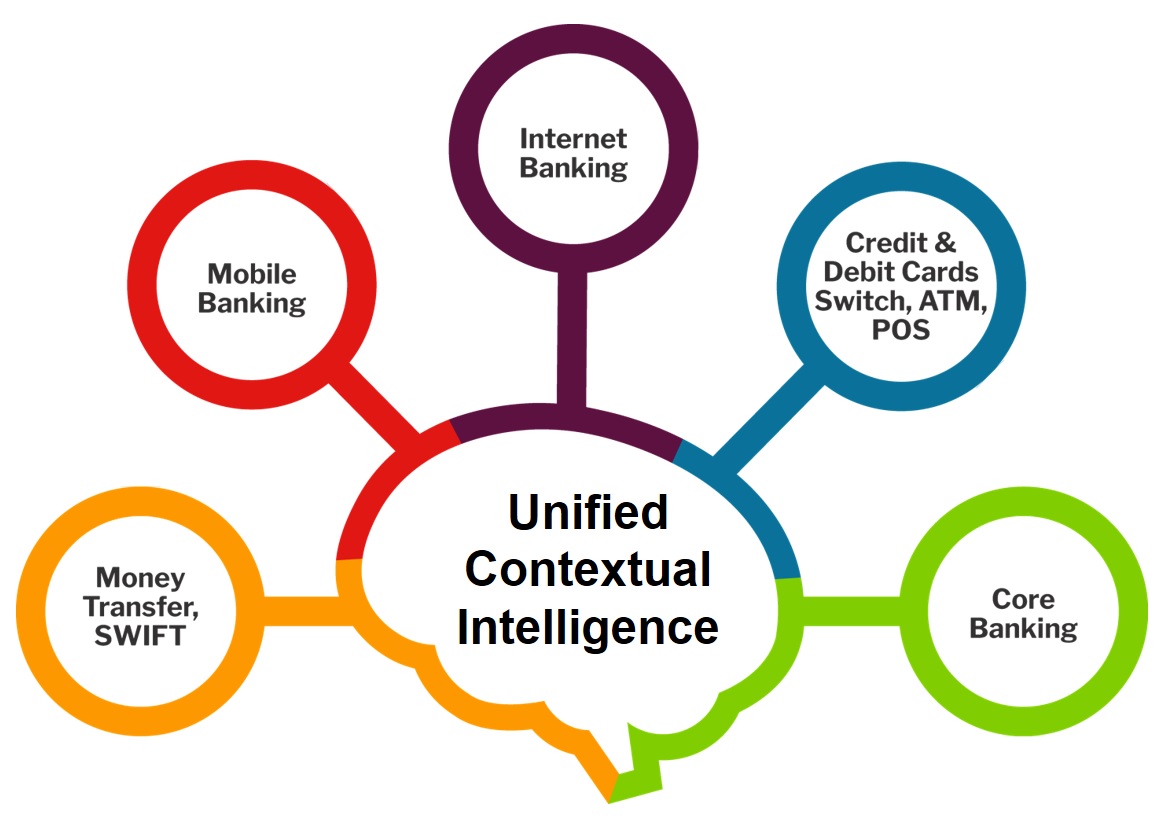

It is essential therefore to have a ‘brain-like, central nervous system’ approach to make a ‘segment of one’ decision every time in real-time. This is quite different from the current ‘starfish’ like system where each limb behaves independently with isolated intelligence. For example, if a customer’s card’s transaction is detected in a far-off location B, a siloed card-only solution will make the decision based on data derived just from cards.

However, a brain-like, real-time, cross-channel approach tells you that the customer is logged in to internet banking in location A and mobile banking in location A and will question the possibility of how he/she can simultaneously be thousands of miles away in location B. It will then quickly figure out what to do, making every such interaction contextual and real time.

We see that this ‘brain’ now has a ‘segment of one’ intelligence, every time for every customer interaction. This is very hard to replicate for anyone – especially for hackers, who typically carry out large segment attacks, that exploit the siloed/isolated nature of the underlying starfish system.

With a human brain-like system, the hacker will need to understand every customer individually across channels to perpetrate serious fraud. Because, not only should the fraudulent transaction be accurate channel-wise, but it should be accurate from the collective intelligence perspective of the customer as well.

Clari5 urges a shift from thinking in terms of monolithic machines that optimize complex queries, to a system that does distributed in-memory computing using commodity processors that scale horizontally.

From a bank’s perspective, this impact is externalized, because a smart system like this is able to leverage the bank’s existing investments and minimizes the overall impact by ensuring that business-as-usual processes are not impacted.

3 Challenges. 1 Solution

Combat fraud while growing revenue

Get 360 degree insights across all channels

A robust system that auto scales as your bank grows

Schedule a Demo

Schedule a 1:1 discovery demo call with our senior product experts to see how Clari5 works and have all your questions answered!