Chartis Research’s latest report provides an overview of trends in financial crime compliance systems that include KYC and AML capabilities. The report positions AML solution vendors as ‘Best of Breed Solutions’, ‘Point Solutions’, ‘Enterprise Solutions’ and ‘Category Leaders’ based on market potential and completeness of offering. Clari5 is positioned as a ‘Category Leader’ in the RiskTech Quadrant for AML solutions, 2020.

Increasing levels of cybercrime and an ever-changing regulatory landscape makes a technology-driven compliance function a necessity rather than a competitive advantage.

With increasing diversity in the banking customers’ age groups, needs, values, priorities and perspectives, banks interact with many ‘generations’ of customers. Multigeneration banking evolved from the need for providing personalized and unique experiences to a variety of customer segments.

From driverless cars to virtual personal assistants, AI is transforming industry sectors but not really when it comes to banking regulatory compliance. Implementing AI-based regtech early can help accelerate compliance.

Clari5 Once Again At Seamless, Dubai > 1/2 May

Clari5 Once Again At Seamless, Dubai > 1/2 May IndusInd Bank – Celent Model Bank Of The Year For ‘Yin-Yang’ Approach in Fighting Fraud

IndusInd Bank – Celent Model Bank Of The Year For ‘Yin-Yang’ Approach in Fighting Fraud Best Fraud Detection Solution for Islamic Banking

Best Fraud Detection Solution for Islamic Banking Synchronizing Your Bank’s EFM+AML Strategy

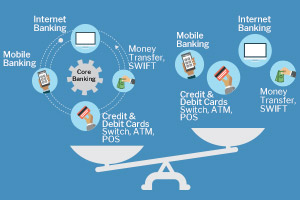

Synchronizing Your Bank’s EFM+AML Strategy

White Paper: Break Filter Bubbles in Banking Enterprise Fraud Management

White Paper: Break Filter Bubbles in Banking Enterprise Fraud Management Report: NASSCOM IT Strategic Review 2017 – featuring CustomerXPs

Report: NASSCOM IT Strategic Review 2017 – featuring CustomerXPs Banks & Fintech Startups See More Value In Cooperation Than In Rivalry

Banks & Fintech Startups See More Value In Cooperation Than In Rivalry Blog: Monetizing Your Anti-Fraud Solution to Make Money for Your Bank

Blog: Monetizing Your Anti-Fraud Solution to Make Money for Your Bank

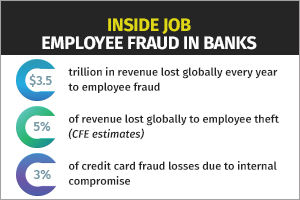

Infographic: Trends Threatening Banking

Infographic: Trends Threatening Banking

‘Money Rolls’

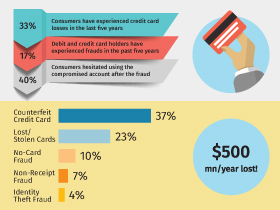

‘Money Rolls’ Infographic: Credit Card Frauds 101

Infographic: Credit Card Frauds 101 Clari5 Case Study: Real-time AML for Prominent Bank

Clari5 Case Study: Real-time AML for Prominent Bank