Banking fraud is a $3.5 Trillion global menace. Indian Banking Fraud number instances have increased considerably over the past few years. This surge in banking fraud has not only resulted in banks losing millions but also sustaining irreparable reputational damage. With such attacks becoming more frequent, RBI has mandated banks to comply with recommended measures to secure the technology infrastructure and improve fraud risk management practices for frauds across channels. There is thus a growing need for banks to incorporate strong combat mechanism for not only detecting but preventing frauds in real-time.

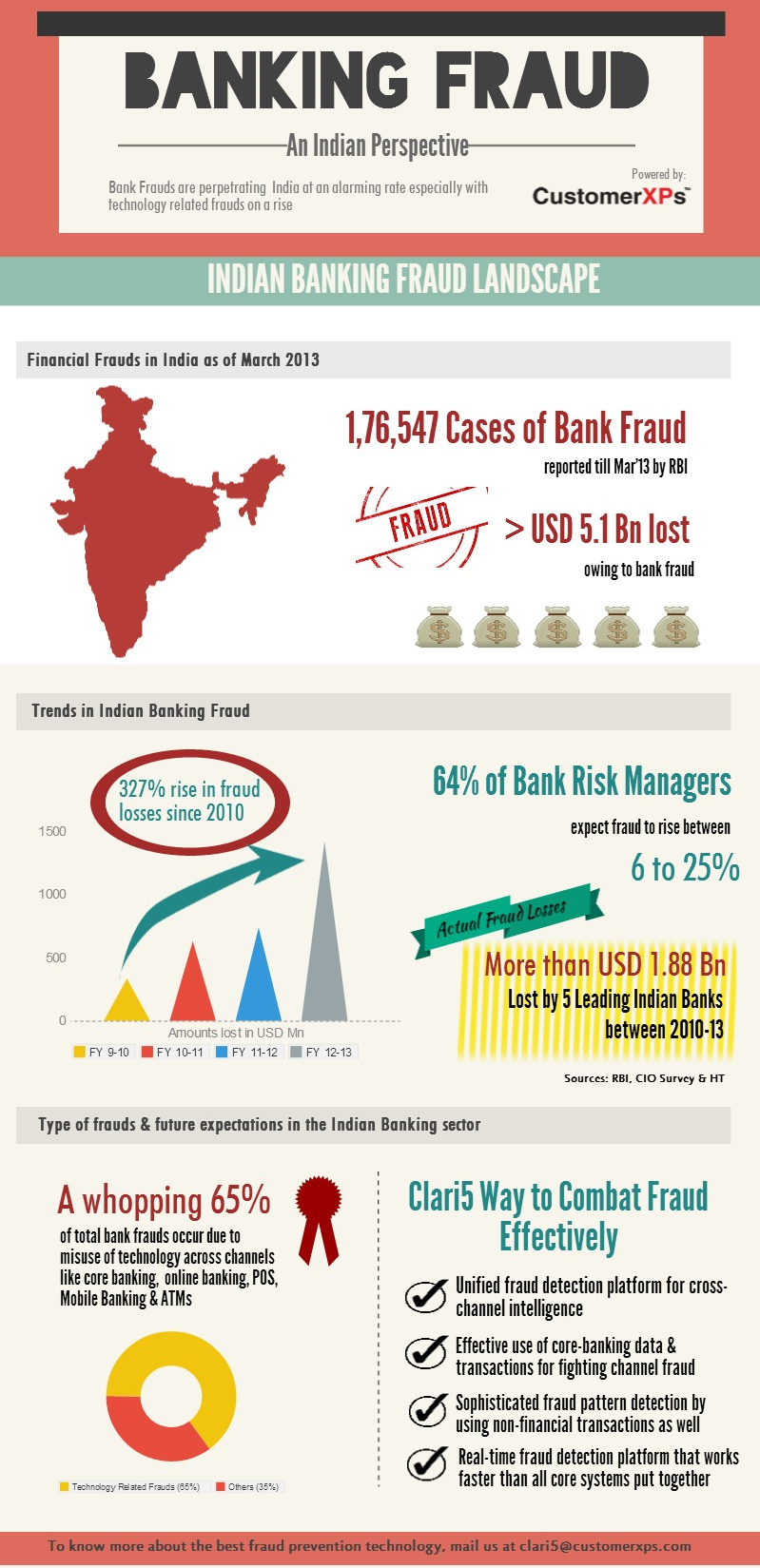

The infographic below highlights recent trends in the Indian Banking fraud landscape and how implementing real-time fraud management technology would combat such frauds in a fool-proof way.