Financial Fraud in Australia

Financial fraud is pervasive. Not only developing but developed countries grapple with fraud. With new channels of financial transactions opening up for consumers, it is becoming even more difficult to monitor fraudulent events in real-time. For instance, online banking & payment cards have become so ubiquitous that we cannot imagine transacting without them in our day-to-day life. On the other hand, banks are threatened by high levels of fraud that are associated with electronic transactions. In Australia, the total amount of money spent on payment cards was AUD 624 Billion in 2013. At the same time, an estimated AUD 1.4 Billion was lost to personal fraud that has emerged as the largest form of financial fraud in Australia.

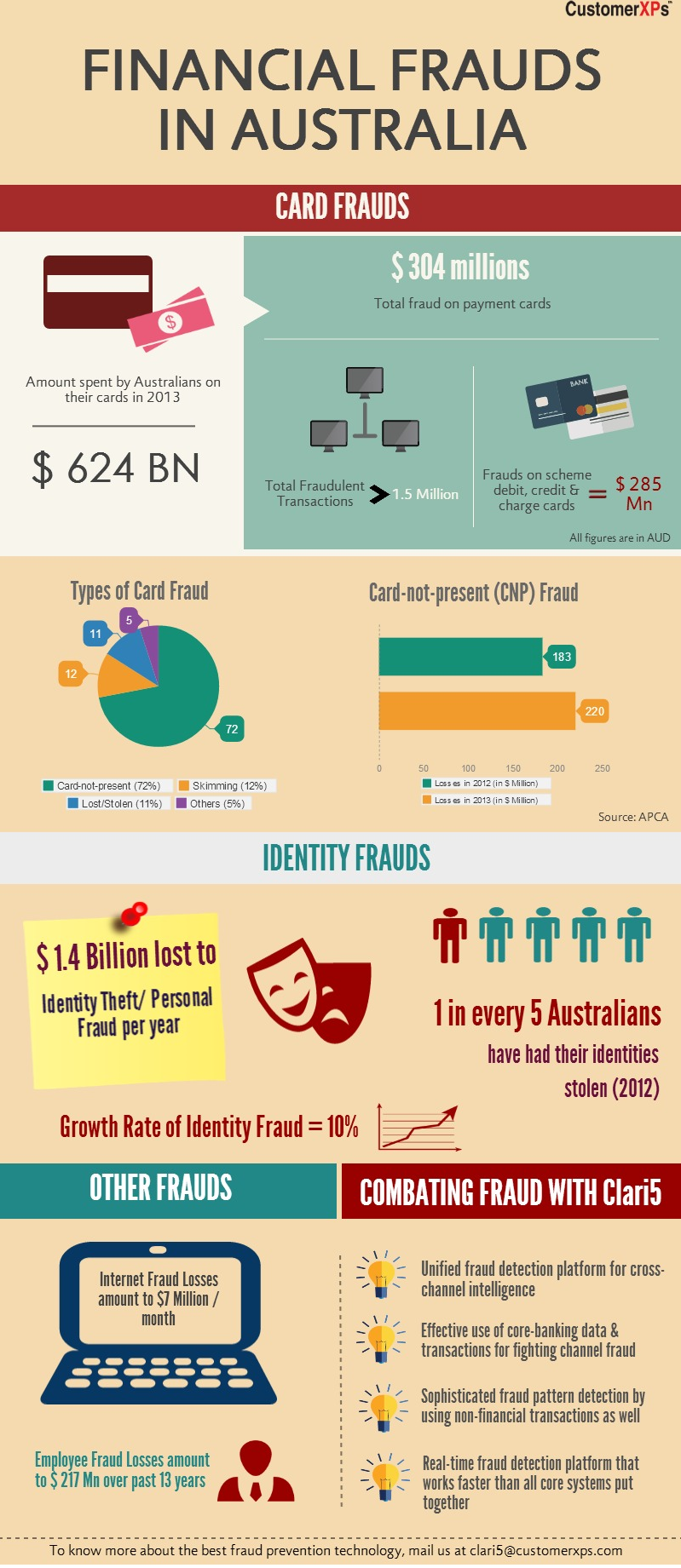

This infographic below delves deeper into the fraud scenario in Australia and highlights ways to combat fraud in real-time.