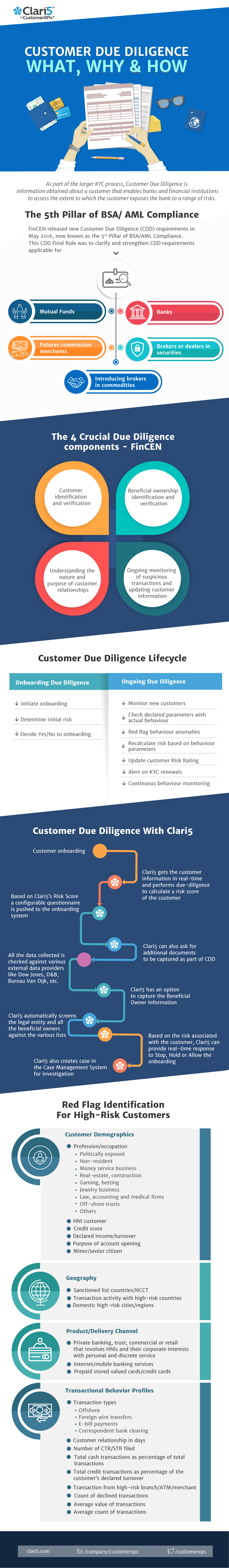

New FinCEN rules under the Bank Secrecy Act to strengthen customer due diligence (CDD) requirements for banks, brokers/dealers in securities, mutual funds and futures commission merchants contain explicit CDD requirements + a new requirement to verify the identity of beneficial owners of legal entity customers. What do the new compliance requirements mean for global financial institutions?