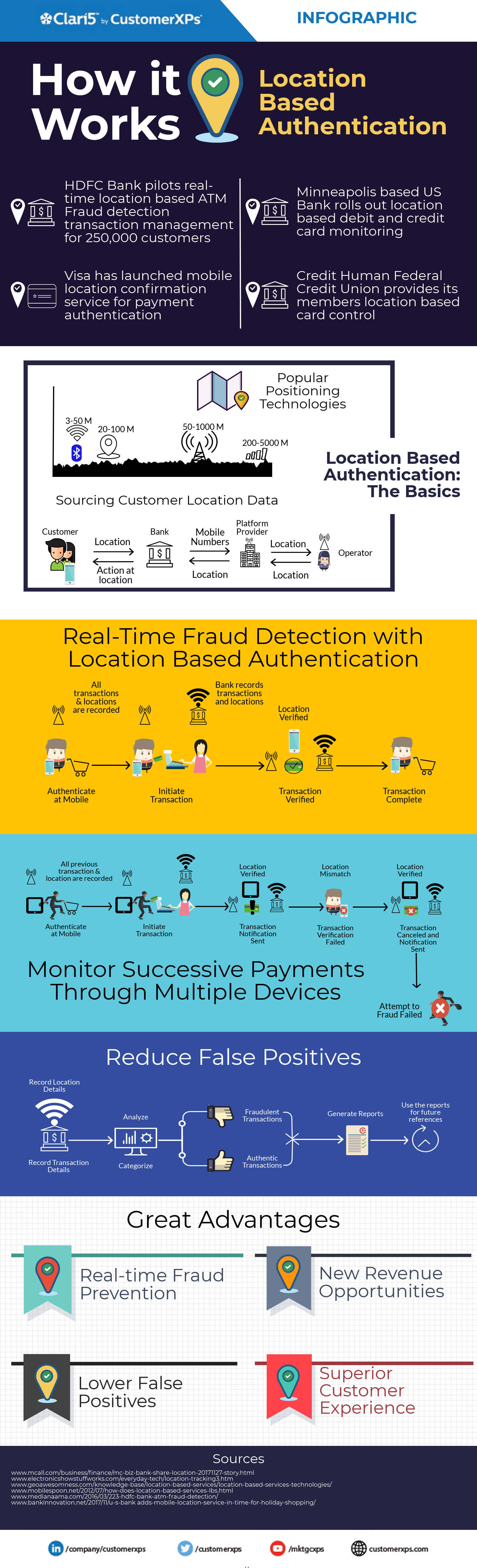

When an unauthorized charge is made in a location other than the one specified by customer, it can be detected automatically. See how location based authentication works in detecting fraud.

When an unauthorized charge is made in a location other than the one specified by customer, it can be detected automatically. See how location based authentication works in detecting fraud.

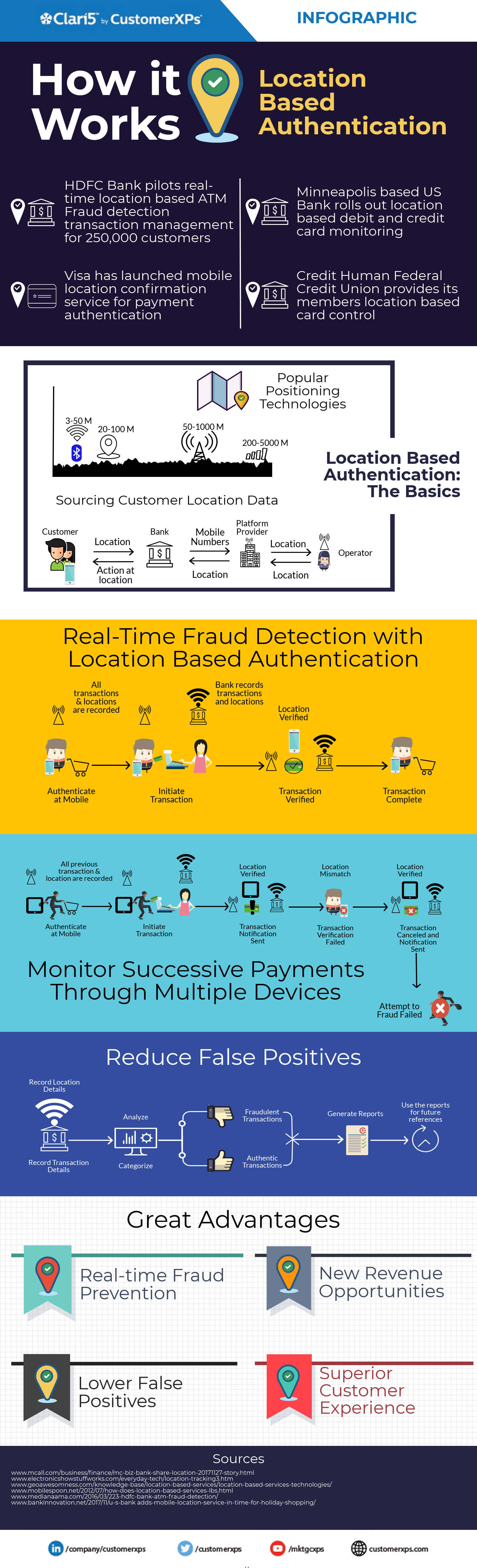

Artificial Intelligence, Blockchain or Regtech? What will take the spotlight next year? As 2017 comes to a close, here’s a preview of the top 10 drivers in the year ahead.

From driverless cars to virtual personal assistants, AI is transforming industry sectors but not really when it comes to banking regulatory compliance. With 300+ million regulatory documents expected to be published by 2020, implementing AI-based regtech early can help accelerate compliance efficiencies.

European leaders have long identified that the future of the financial services lies in the co-existence of the conventional banks with emerging fintech. However, to reach to that stage, security of the customer data is the major challenge. Despite industry efforts, fraudulent transaction levels are on the rise in Europe.

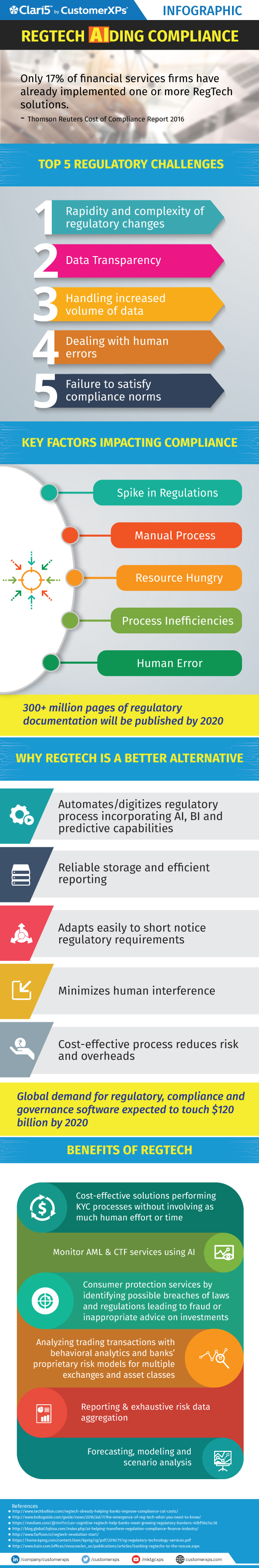

Payments Services Directive 2 (PSD2) introduces the concept of Strong Customer Authentication (SCA) to provide transaction security. However, this can put Payment Service Providers (PSP) in a Catch 22 situation by having them tread the thin line between transaction security and customer experience.

Let’s see how Risk Based Authentication (RBA) as mandated in the PSD2 guidelines can play the balancing act without compromising on security and ease of use.

PSD2 applies to payment services in the European Union (EU) and is framed by European Banking Association (EBA). The directive focuses on all electronic payments including card present and card not present transactions. PSD2 provides data and technology driven directive to regulate the previously unregulated third-party payment service providers.

In doing so, it increases competition with the aim of making payments and account access more innovative, transparent, efficient, and secure for the consumers.

Without going into the nitty-gritties of the guidelines, here’s a summary of the major FAQs.

Introduction of New Players: PSD2 defines the role of Third Party Providers (TPPs) and their services. There are two types of TPPs viz. Payment Initiation Service Providers (PISPs) may initiate a payment transaction directly from the customer’s bank account and Account Information Service Providers (AISPs) consolidate the customer’s account and transaction details from multiple banks in one portal

Transparent Access to Accounts: PSD2 formulates the rules for access to the customer’s accounts (XS2A). Banks are mandated to open their core banking infrastructure via APIs to licensed TPPs. This will allow TPPs to provide account information services and enable payment initiation services.

Strong Customer Authentication: SCA is an authentication process that shall include two or more authentication factors viz. knowledge, possession, inheritance (biometrics). PSD2 mandates the use of SCA whenever the customer initiates any electronic payment transaction, whether to make a payment or access bank/TPP services.

PSD2 introduces strict security requirements for the initiation and processing of electronic payment transactions and access to accounts. One RTS in PSD2 is focused on a definition of Strong Customer Authentication (SCA), including when and how a PSP must ensure it is their customer making a payment or request for account management.

In a nutshell, SCA is a customer authentication process that must include at least two out of the three authentication factor types:

As per the draft technical standard published by the EBA, SCA has to be applied in 3 cases.

PSD2 brings into the jurisdiction, one legged transactions, i.e. those payment transactions where the payer’s or the recipient’s PSP is based outside of the EU. So, SCA has to be performed for these transactions as well.

The impact of PSD2 therefore is more global instead of localized only to Eurozone, as anticipated earlier.

Customers have been prioritizing experience over security, but this seems to be slowly changing with regulators driving greater security.

The impact of the requirements for Secure Customer Authentication is set to radically change the customer experience and journey. Initiating a 2-factor authentication for every transaction or account access has a serious impact on customer experience.

‘One click checkouts’ will be thing of the past and many fear it will stifle innovation in the Payments space rather than promote it.

However, EBA has allayed fears of banks, merchants, e-commerce companies, etc. by including clauses for exemptions from Strong Customer Authentication.

The exemptions for SCA are debated, because of the need to find a balance between security, fraud reduction, innovation, competition, user-friendliness and accessibility.

In the EBA guidelines, the situations where a PSP is not obliged to use SCA include when the customer is:

Evidently, these clauses correspond to either fixed restricted usage rules or prior authenticated parties. But the final case provides PSPs with a certain level of control for transaction, provided they perform Transaction Risk Analysis.

It lays down the foundation of Risk-based authentication of the payment transactions thus playing crucial role in reducing customer friction.

Risk-based authentication is not a new concept by the EBA. It has been around for quite some time now. However, this time the concept has emerged as an unambiguous and fair solution for security vs convenience trade-off.

The EBA has mandated PSPs to put in place transaction monitoring mechanisms in order to enable them for detecting unauthorized or fraudulent payment transactions.

PSPs are expected to ensure that the transaction monitoring mechanisms takes into account, at a minimum, certain risk-based factors on a real-time basis:

What this means for the PSPs is that, using these transaction monitoring systems, they are able to record these parameters and further use them to validate incoming payment transactions from a fraud perspective.

PSPs can use these parameters to risk rate the payment transactions and in turn use it as a criterion to avoid Strong Customer Authentication.

As per PSD2 guidelines, PSPs on a minimum shall –

If there is a fraud indication in any of these checks, then that shall call for either strong customer authentication for the transaction or rejection of the transaction. The final outcome desired is that by using these checks, PSPs shall be able to keep their fraud rates below the reference fraud rates set by EBA for remote payment transactions.

By achieving this, they will be able to accept and process payment transactions without applying further SCA and as a result be able to provide better customer experience.

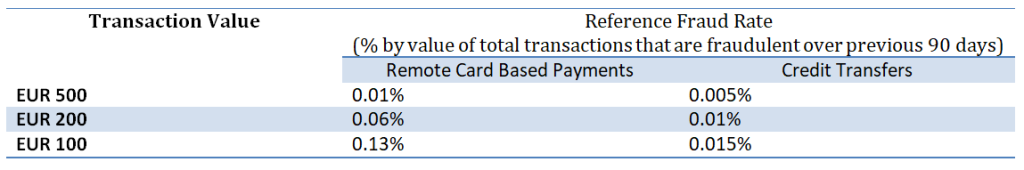

Reference fraud rates asset by EBA:

The PSPs shall notify the national centralized authorities about their intention of using exemptions from SCA basis the lower fraud rates. The minimum requirement is reporting detailed loss rates by exemption every 90 days.

These statistics must be broken down across all payment types, remote card payments and remote credit transfers, including where no exemption is used. If for a PSP, the monitored fraud rates are above the EUR 100 reference rates for 2 consecutive quarters, then that PSP shall cease the usage of exemption from SCA. However, if the monitored fraud rates fall below the threshold for a consecutive 90 days, they are free to exempt future transactions from SCA.

PSPs also must have real-time fraud management, so that being able to know the trends in fraud rates on a daily basis will allow them to tune authentication policies. Else, how will the PSP know the fraud rates at the time of reporting? Also, Daily Fraud Rate is a better measure of fraud rate compared to the Daily Average Fraud Rate, which is computed at the end of the quarter.

The need of the hour for PSPs is to balance security and customer experience. As evident from the EBA guidelines, there’s no single way to combat the problem. We need a multi-pronged strategy. PSPs must adopt a hybrid approach to fraud detection and prevention, which should include a rules based system, behavior profiling of customers/devices/users, link analysis between entities, and machine learning based predictive risk scoring.

These features can help reduce fraud at the bank while also reducing false positives which in-turn will help PSPs to provide a superior customer experience.

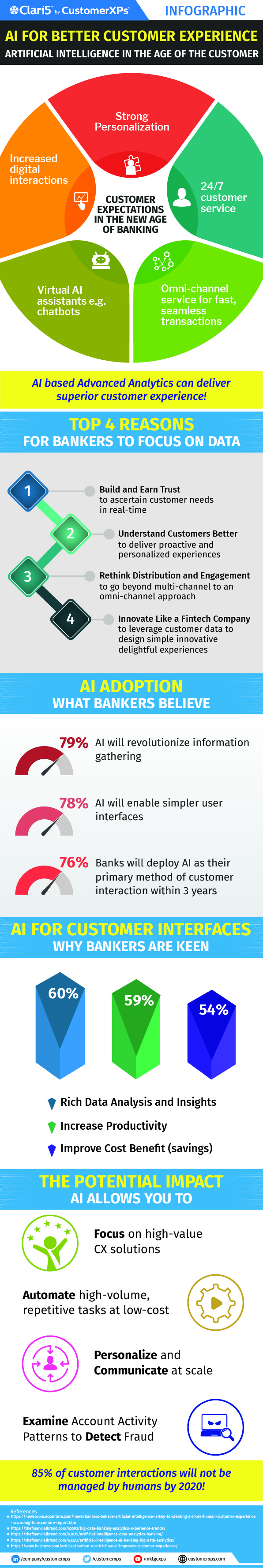

80% of bankers believe that AI will revolutionize the way information is gathered and expect AI to accelerate better customer experience. See the stats and how AI is set to transform customer experience in banks.

The phrase big data has become a buzz word. Everyone talks about it or has information in bits and pieces, but only few companies know how to utilize the same. Big data is characterized by the tremendous volumes, varieties and velocities of data, that are generated by a wide array of sources, customers, partners and regulators (IBM)

Banking is among many industries which has a vast and useful data about their customers. But right now, only a handful of banks are utilizing this pool of information and taking steps to enhance Customer Experience and deducing the data to combat fraud. Banks are aware of the fact that if the data is used smartly they will be able to cater to the needs of customers accurately.

As per research from (Capgemini) only 37% of customers believe that banks understand their needs and preferences. Banks have an abundance of informative data, but the major challenges they are facing today is how to utilize it intelligently, shortage of skilled people, insufficient tools, time constraints, the high cost associated, unstructured vast data and much more.

Most of the banks have silo based solutions to harness this pool of information. (Capgemini) research shows that organizational silos are the single biggest barrier to success with big data. Banks should apply 360 degree approach and understand the customers’ needs and act accordingly.

Big data can do wonders for banks if mined properly. Big data help to limit customer attrition, help in relationship management, increase in ROI and reducing fraud. Big data can be utilized to:

Big data is being increasingly used and studied by banks now. Banks have understood the potential of big data and are taking measures to apply it. Banks should come out of their silo based legacy solution to more wider and useful approach that will not only enhance customer experience, but also will help them to increase ROI, prevent fraud and reduce attrition rate.

1. Offer to downgrade: Banks can bombard the best customers with offers to downgrade their status. For example, they can get the relationship manager to call the platinum card holder and offer her to issue a silver credit card.

2. Cross sell irrelevant products: Its relatively easy doing this. Run the algorithm on a customer relationship and identify the least fit product. The teller can than try to cross sell it to the unsuspecting customer. A new low can be achieved by wrong-timing the pitch. Example: Offer a car loan at a cheaper rate to customer who purchased car last week.

3. Antipathetic complaint redressal mechanism: There are more than one ways to do it. Make customers jump through hoops to reach the customer care executives. Refuse to acknowledge that the problem exists. Get customers to start over every time they want to check the status. Cross sell irrelevant products when the customers call to complain.

4. Commoditize the customer: Converting the customer from individual to a commodity has monopoly rule at the pinnacle of horrible customer experience. One sentence that really does the trick is,” we deal with hundreds of customer like you.”

5. Continue with antiquated processes: After all, old is gold. Continuation with antiquated processes will ensure that customers have to fill forms in triplicate and visit multiple counters for each transaction. Then cross sell irrelevant products to them.

From the days when customer experience management was more titular than operational, today its closely correlates with lower customer attrition and better financial results for the banks. Hopefully, the banks will endeavor to avoid the above 5 mistakes thus achieving superior results.

Ratnesh is Head of Marketing at CustomerXPs.

He can be reached at clari5@customerxps.com

CustomerXPs offers real-time, intelligent products that empower banks with instant insights enabling influenced outcomes of deeper customer engagement and fraud-free transactions.