Trust, in-person interactions, reasonably good response levels, absence of alternative options – were some of the reasons that brought people to banks before the era of digital and banking domain monopsony. The strategy worked well and it helped create predictable growth and profitability – until the level playing field tilted.

It is no longer just banks that are able to leverage massive data volumes and technologies to provide better financial solutions. Besides from their peers, banks are now faced with intense competition from new quarters – mainly technology giants and fintech firms – who have been gorging away large portions of what was once their bastion.

Fintech start-ups and big tech firms from the FAANG group, who have forayed into the financial services turf have convinced vast numbers of potential customers to engage with them and existing customers to switch loyalties.

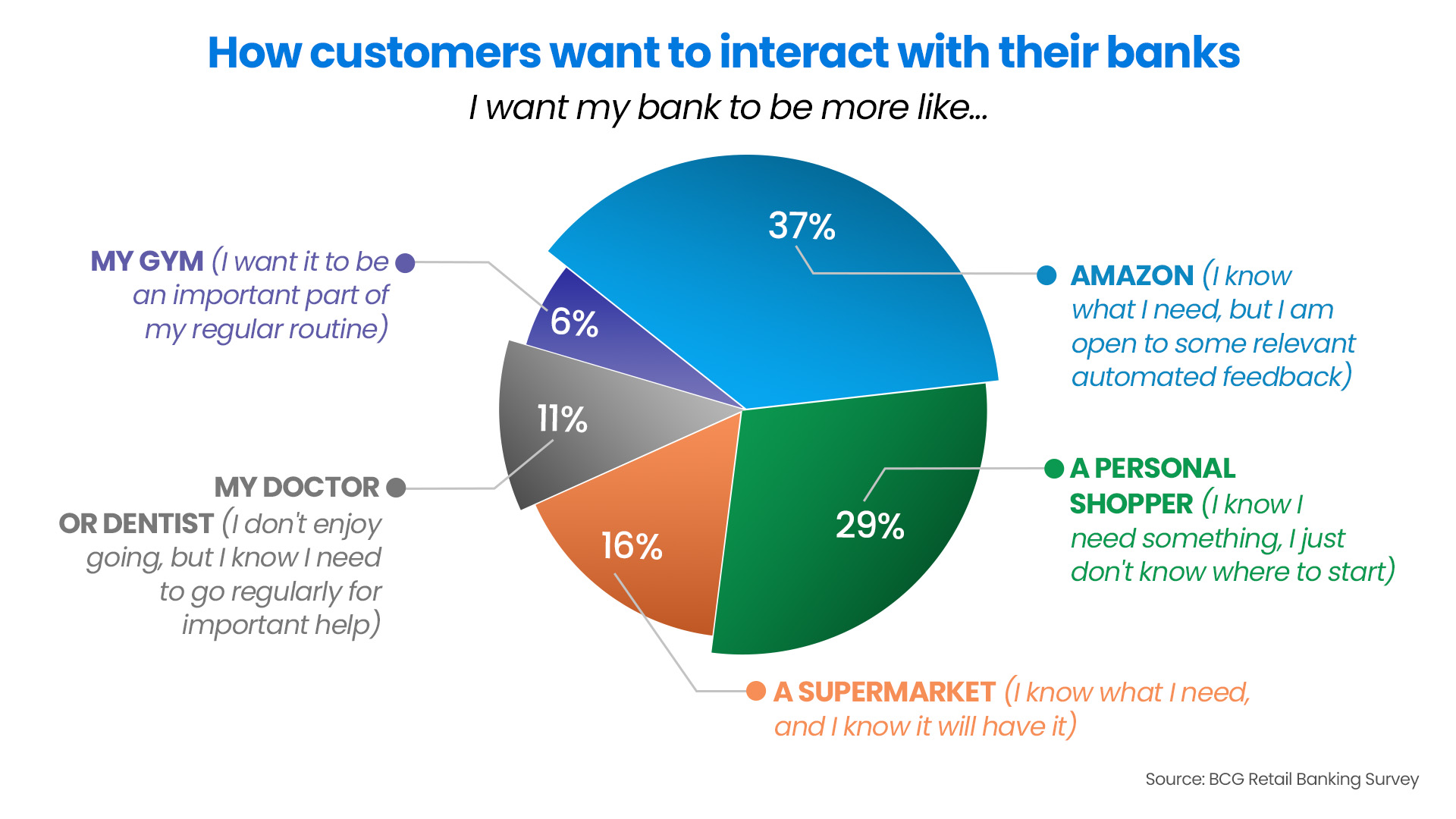

Consumers expect their bank to understand their needs and deliver personalized solutions similar to how they receive from FAANG. A recent study reveals most people who are considering changing banks are open to start banking with a fintech or a big tech firm!

A big factor in the success of the new players is personalization – a keystone of their business models.

A big factor in the success of the new players is personalization – a keystone of their business models.

Another recent study reveals that 63% of customers say that they will not switch loyalties if their FI provides great financial advice, hands-on help with problem resolution, and guidance on how to grow their money. 78% of customers say they will definitely use their bank if it provides additional services. But how do you do that when you don’t know enough about a customer’s goals or priorities? Only 6% of banks say they have the capability to provide highly personalized outreach.

Another critical factor that has customers switching to financial service providers that they have not used before, is the availability of new, exciting features.

The style and format of interactions have changed drastically and customers expect a lot more from their banks. They feel assured when the bank knows who they are, the history of their relationship with the bank, that the bank values their business, and that you can help them resolve any issue or concern they may have.

The current environment is extremely transactional. Instead of knowing their bank tellers by name, customers are more keen for superior real-time experiences (whether digital or in-person) and great deals (low / no charge maintenance fees, best rewards system for credit cards etc.).

In an intensely dynamic environment, it is vital to understand newer ways to take consumers to the pinnacle of satisfaction. Even though the presence of digital channels has made it easier for customers to communicate with their banks, there is growing frustration due to the absence of listening or personalization by FIs. Hyperconnected customers want their banks to speed up digital transformation and offer more security, advice, and digital and environmentally responsible products and services.

A ‘Segment of 1’ Approach

Decades ago, businesses learnt that they could sharpen their focus and tailor products and services for specific customer segments. A segment today can be trimmed right down to an individual.

A segment of 1 approach is the coming together of 2 independent elements – information retrieval and service delivery – to become a force multiplier. On the one hand is brilliant insights about customer preferences and purchase behaviors; and on the other – a meticulous service delivery that leverages the insights for crafting a unique service package for individual customers.

The advantage is simple yet powerful. Consumers are increasingly expecting to be treated as individuals and want customized products and services delivered at that precise moment of need. Add to this, the reassurance and trust of a relationship with a brand that understands and responds quickly to their specific needs.

When crafted well and deployed effectively, innovative personalization strategies, driven by a ‘segment of 1’ approach, can achieve substantial gains.

What Have Banks Been Doing?

Demographic Targeting

Most banks are already customizing content based on demographic segmentation. They combine multiple demographic points to define customer segments more narrowly. The narrower the segmentation, the more targeted and effective the outreach.

Behavioral Targeting

Data such as web activity, email clicks and campaign engagement, helps target customers better. Campaigns developed using additional information about behaviors and choices are more impactful than ‘fits-all’ campaigns. Several banks have been able to drive growth using this approach.

Psychographic Targeting

Information about attitudes, interests, values, and lifestyles requires analysis of insights from diverse external sources – web / social media data, surveys, third-party data providers – making it a bit more complex. A few banks have been using psychographic data to segment customers for sharper targeting.

What Could Be Better

While segmentation helps targeted (and to a certain extent, personalized) marketing, personalization is about creating insights-driven real-time experiences. To compete and grow today, banks must have personalization as a strong new pillar in the overall growth strategy.

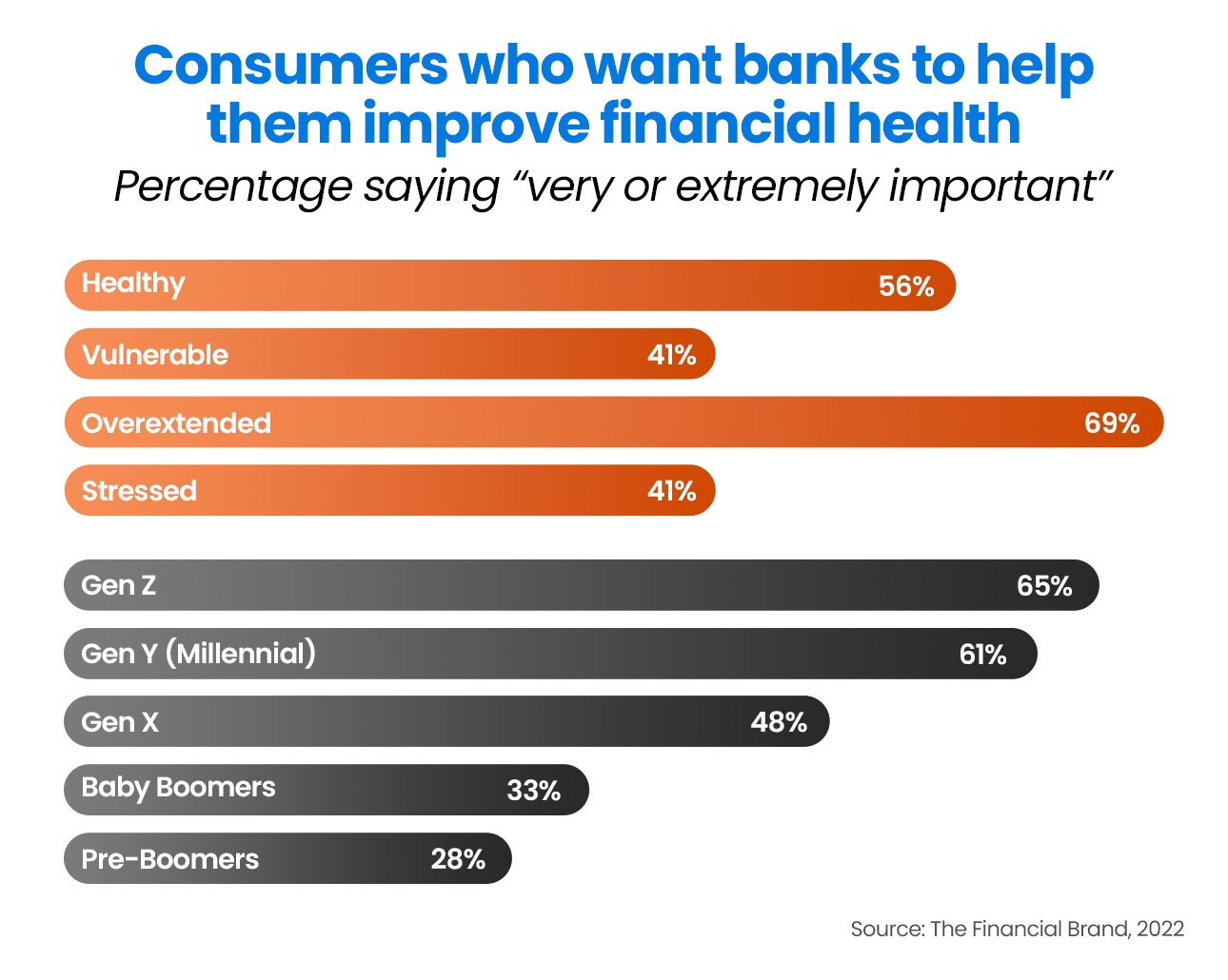

Customers expect their bank to understand their goals and preferences, and proactively deliver the right offers and services to help them achieve better financial well-being and are willing to share insights with their bank. This is in stark contrast to the quantity of insights most banks are willing to ask, collect, and utilize for the benefit of the consumer.

Data insights and communication technologies have become ubiquitous, affordable, and far more accessible. Banks regardless of size, can harness them to deliver the level of customization that today’s customer expects.

Personalization is much more than showing the customer’s name on the bank’s web or mobile page. To be genuinely impactful, banks must personalize the entire customer journey to engage with the brand. Banks must use customer insights to map customer journeys and identify opportunities for personalization.

The starting point lies in the goldmine of insights already residing across delivery channels, but in silos. No other industry has the kind of width and depth of insights available as much as the banking industry. In fact, only a bank (as opposed to any other business) literally has the complete ‘soul’ of the customer and is best positioned to monetize it.

Personalization is fast becoming a point of consumer differentiation between financial institutions, fintech firms, big tech firms and non-financial players. To create deeper personalized experiences, banks can do more from the insights available, for every single interaction with each of their customers.

When implemented well, personalization can take segmentation, targeting, monetization and customer experiences to the next level:

Unified View

A strong personalization strategy requires far deeper understanding of everything about the customer, the experiences being delivered currently, the best channels necessary for personalized interactions. This means intense focus on insights about each customer and their individual universes. It helps to have customer information accessible in a single location, for collaborative development of personalization strategies.

Omnichannel Personalization

Uses multiple information sources to create a 3D view of a single consumer. Banks must connect data from campaigns and other parts of the organization to create a unified view. For example, this is useful in the case of customers who were either referred, or are part of a remarketing goal. Banks need to discover the trail and craft their next touchpoint– whether they’re online or offline. The more the strategies are based on specific personas and defined outcomes (with unique approaches for each channel), the better / higher the impact.

Synchronized Tech

Delivering personalized experiences requires multiple technology solutions working together, e.g., a bank’s contact center and CRM solution working in tandem for a richer, personalized chat interaction.

Better Findability

In 2022, about 97% of consumers used the internet to find information about local businesses. Customers also often include the city name or even a zip code in their searches. There are also potential customers looking for a new bank when they move to a new city. Also, only 35% of banks and credit unions use location data in their campaigns. Not leveraging location-based targeting means missing out on potential opportunities.

Location Extensions

Popular search engines allow businesses to add location extensions and call extensions to text ads. This enables businesses to display their co-ordinates, phone number, and a map marker that gives directions. When this extension is enabled, the most appropriate branch locations are dynamically selected by the ad platform based on the customer’s location or search data. This option ensures a seamless experience for consumers and allows them to find branches closest to them. It also keeps business information up-to-date on major ad platforms, review sites, and mapping platforms.

Geo-targeting

Banks with multi-locational presence can create local (PPC) pay-per-click ads. They can use radius targeting to define specific areas around their branches and then drive customers in those areas to unique landing pages, to boost both relevance and personalization. Popular ad platforms offer the ability to target customers based on their physical location or even their search intent. Metrics can be determined by keywords in customers’ search terms or based on the implied location from previous searches.

Geofencing and Beacons

Digital banking is expected to exceed 3.6 billion users by 2024 and contactless mobile payments will exceed 1 billion users in 2024 (Juniper Research). Banks that have realized the potential of mobile banking are actively trying to connect with the young population that mostly uses mobiles for banking. Many banks are now using geofencing and beacons to deliver campaigns on mobile platforms. So that when a customer enters a particular geographical area, display ads, content, or push notifications are sent to the consumer’s device. Geofencing content is delivered within a fixed radius of the location, based on the GPS data from the customer’s phone, while campaigns that use beacons are activated when a customer nears a Bluetooth device that has detected that the customer is in the vicinity. The only prerequisite is that they work only when the customer’s GPS or Bluetooth settings are turned on.

Innovations across data sciences, predictive analytics, AI and machine learning have all enabled banks to quickly transform information to insights to personalization. AI and machine learning help automatically create efficient self-learning models in real-time, which can be used to deliver contextual ‘in the moment’ experiences with each interaction. But, despite advances in technology, most personalization expectations remain unfulfilled.

Tech giants, fintech firms, telcos, e-tailers, social media, media & entertainment leaders have all set a lofty bar for personalization. Quite naturally, consumers have raised the bar on their expectations from their banks. With customers willing to share insights with their banks to receive more personalized services, it has never been easier than now for banks to create personalized experiences.

‘The’ Competitive Differentiator

Customers look up to banks as vital institutions that play a key role in their financial well-being. Personalized engagements not only differentiate a bank from other banks but also from fintechs and big tech firms. Technology advances has made it easier for banks to take advantage of the new reality. Banks can reap the benefits of personalization strategies faster than they previously did. But they will work best when deployed as an integrated ‘segment of 1’ strategy.

Eventually, it will also be possible to access a single source of insight that will enable seamless integration between back-office processes and real-time customer experiences. From a business growth point of view, the implications are dramatic. ‘Segment of 1’ personalization will activate a radically new way to engage and satisfy existing and potential customers. As a result, competitive advantage will tilt back to the original ‘owners’ of the banking space.

References:

BCG: What Does Personalization in Banking Really Mean?

Financial Brand: Digital Banking Readiness Is Top Priority in 2023

Financial Brand: Economy Alters Retail Banking Outlook for 2023 and Beyond

Juniper Research: Digital Banking Users To Exceed 3.6 Billion Globally By 2024, As Digital-Only Banks Catalyse Market